Apply for an account in 4 mins

Download the Countingup app to apply for your business current account – all you need is proof of ID and a few details.

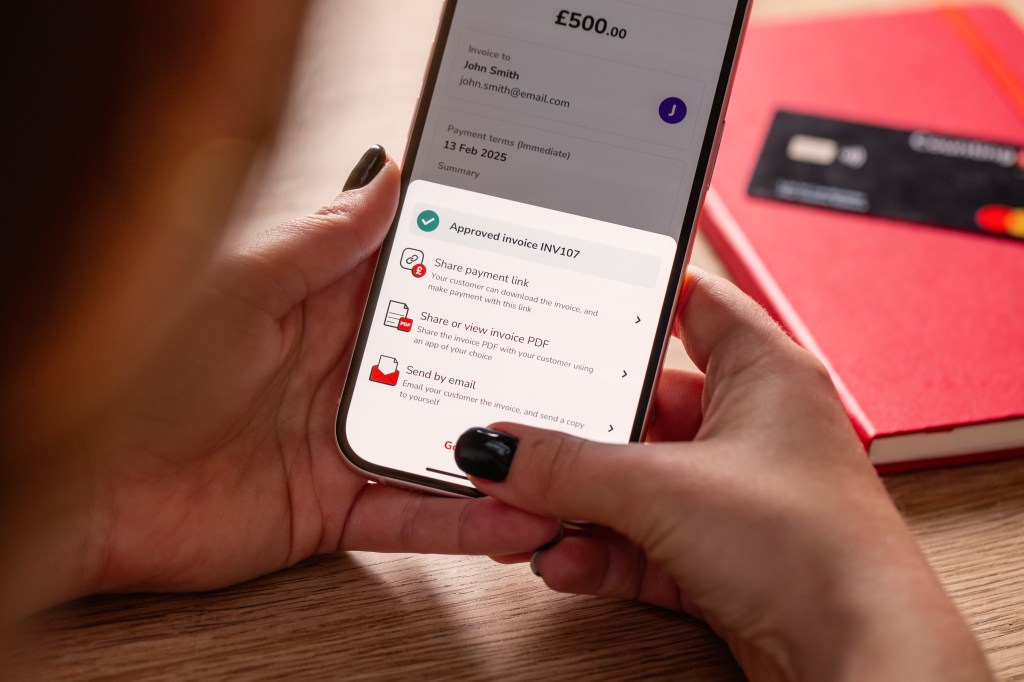

Take payments by invoice, payment links or card. However your customers pay, Countingup helps the money flow in, fast.

Your expenses, taxes and reports are sorted automatically, and always kept up to date. Your time’s better spent on your business, not your books.

You didn’t start a business to get buried by tax admin and the stress that comes with it. That’s exactly why Countingup handles the heavy lifting, so you can focus on what you love.

Our plans are based on your monthly income, you only pay more as your business grows. Plus you get a business current account, accounting and tax tools included – that means big savings on separate accounting software, tax support and accountant fees.

Ready to forget everything you know about business banking? Join today and get a 3 month free trial.