Tax estimate tool – no more tax surprises

Table of Contents

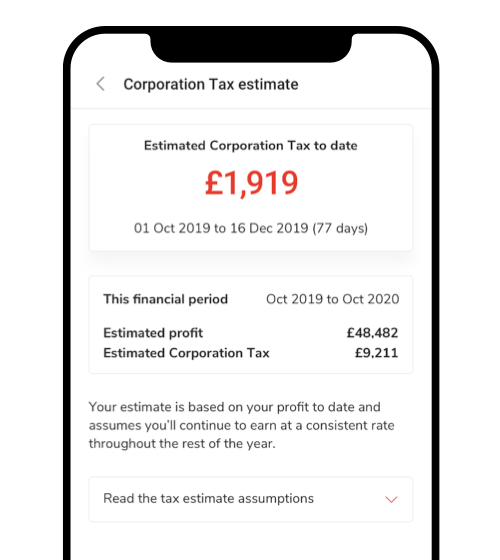

Say hello to the Countingup Tax Estimate tool

As the self-assessment tax deadline passes for another year and more than 1 million tax returns are still to be submitted, the worlds of banking and tax continue to collide to create new innovations for small businesses. We created the Countingup Tax Estimate tool to help make next year that bit easier.

Our tax estimate tool is built into your business current account. It joins a suite of accounting features including invoicing, expense capture and profit and loss reporting.

For our self-employed sole trader customers, the tool provides a real-time estimate of how much Income Tax and National Insurance you owe under Self-Assessment. For our limited company customers, the tool provides a real-time estimate of how much Corporation Tax you owe.

Our tax tool means no more tax surprises for small businesses. Inside your Countingup business current account, you now have insight into how much your tax bill is likely to be at any point in the year. It’s a UK first from a business current account provider.

Tax outstanding

Figures released from HMRC revealed that five million tax returns were outstanding at the beginning of January. Historically, January is a painful time of year for small businesses and accountants. Not only is there pressure to get last-minute tax returns submitted but there’s the cashflow hit to pay the tax. For small businesses with a shoebox of receipts and spreadsheets, the pressure is only going to get worse when Making Tax Digital will require four quarterly tax returns every year.

Not anymore.

For small businesses using Countingup, there will be no more tax surprises or stressful Januarys.