How to open a Barclays business account

Table of Contents

When starting a new business, one of the first things you need to do is open a separate business account to manage your finances. Barclays Bank is one of the biggest names in the UK and has a range of accounts to suit most businesses.

This guide will show you how to open a Barclays business account and look at other options to help you decide whether it’s the best option for your company.

We’ll explore:

- Barclays business account options for small businesses

- General features of Barclays business accounts

- How to open a Barclays business account

- What you need to open a Barclays business account

- Finding the best business account for your business

Barclays business account options for small businesses

For small businesses, Barclays offers three business accounts, which are as follows:

Start-up business account

The Startup Business Account is specially designed for new businesses. Signing up gives users access to the basic tools and support (payment management, invoice tracking, specialist advice) that startups might need to get off the ground.

Business account for turnover up to £400k

This Barclays everyday banking solution is designed for larger or growing businesses, offering features like international expansion and support with acquisition.

Community account

The Barclays Community Account offers free everyday banking for charities, social enterprises and other small not-for-profit organisations and access to convenient and simple banking services.

General features of Barclays business accounts

You’ll be able to access varying features depending on the business account you choose to set up with Barclays, plus your business size and concept. That said, most Barclays business accounts offer some general features, including:

- Mobile banking on the move with the Barclays app

- Access to business debit and credit cards

- Access to knowledge and support from specialist teams and local business networks

- Safe, secure online banking

- 24/7 UK-based customer support

- Time-saving tools like group payments and cash collection booking

What you need to open a Barclays business account

In this section, you’ll find a summary of what you need to open each type of Barclays business account.

To open a Start-up Business Account, you must be an existing Barclays customer (due to a post-pandemic surge in demand) and operate either as a sole trader or a one-person limited company.

In addition, to open the start-up and established business accounts, applicants must also:

- Be at least 18 years old

- Have the right to live in the UK permanently

- Provide at least 12 months’ UK address history

When applying, you’ll also need to provide the following information:

- Your Companies House registration number, if you have one

- Details about your business, including tax information and turnover

- Director details (that’s you)

- Your address history for the past three years

How to open a Barclays business account

It’s worth noting that applying for a Barclays account can take up to two weeks to process due to the high volume of applications. If you still want to open a Barclays business account, you can do so in a few ways, including:

Online application

Barclays allows you to apply for all its business accounts online, except for the Community Account, which you need to call their customer service team for. You can open an account online by completing an online application process. Alternatively, you can use the Current Account Switch Service to transfer your accounts to Barclays from your existing bank.

Assuming you have all the documents you need beforehand, you can open a Barclays account online in 10-15 minutes. If you’ve included all the necessary information and circumstances are straightforward, Barclays aims to open your account in five working days. That said, sometimes it takes even longer.

Visiting your local branch

If you don’t fancy applying online, you can also open a Barclays business account by visiting your local branch. If you choose to open an account this way, it’s a good idea to call and make an appointment first to check if Barclays currently accepts new customers. During the call, it’s good to find out what information and documents you’ll need to bring to your appointment.

Over the phone

Would you rather complete your application process over the phone? In that case, you can call Barclays business banking support on 0800 515 4621. Lines are open from 7 am to 8 pm on weekdays, and 9 am to 5 pm on weekends and bank holidays. Make sure you have all relevant details to hand when you call.

Finding the best business account for your business

Running your business alone is complicated enough as it is, so it’s crucial to find a business current account provider with the tools you need to manage your finances effectively.

When operating as a sole trader or running a limited company alone, the Countingup business current account might be a better option for you.

This unique two-in-one business current account and accounting software automates the time-consuming aspects of bookkeeping, taxes, and more. This means you can manage your financial activities through one app.

Countingup also generates key business insights, including up-to-date and accurate cash flow reports that show how your business is doing at any time. You can access these insights with a tap on your phone to track your business performance easily and make adjustments as needed.

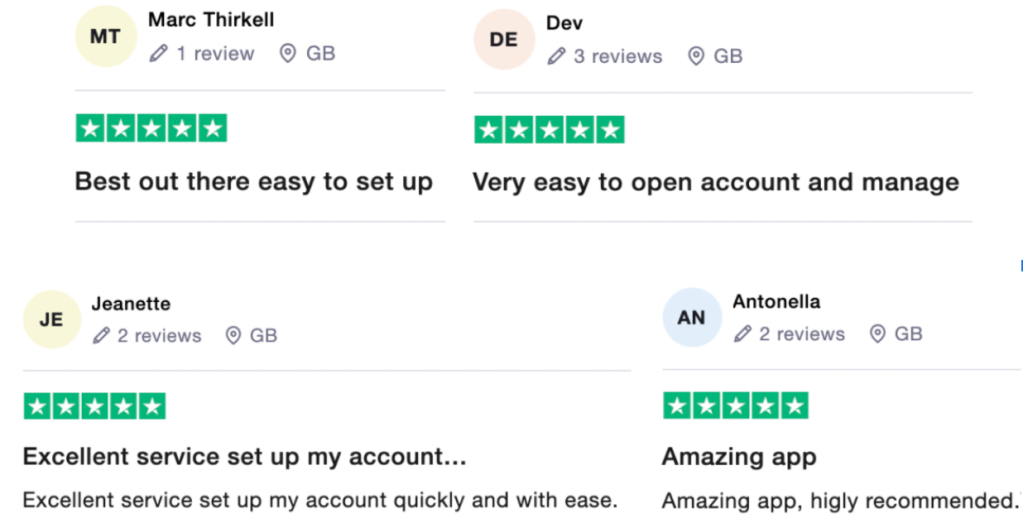

What customers say about Barclays vs Countingup

When deciding what system will support your needs best, it’s good to look at reviews online to see what existing users think about your chosen provider. Here’s what people say about Barclays bank:

On Trustpilot, Barclays has received 1.5 out of 5 stars, meaning most customers review it as ‘Bad’. The main reason for the low score appears to be poor customer service. On the flip side, the Barclays banking app is much more popular with users, receiving 4.8 out of 5 stars on the Apple Store and 4.7 out of 5 stars on Google Play.

In comparison, Countingup has scored 4.6 out of 5 stars on Trustpilot. Trusted by more than 50,000 users, most of whom review the app as “Excellent” thanks to its ease of use and the dedication of the customer service team. Users also love how fast and easy Countingup is to sign up to.

Sign up for a Countingup business account in minutes

Download the Countingup app on your phone to sign up in minutes! As long as you have the relevant information nearby, you can apply for an account online from anywhere.

You generally only need to provide:

- Your name

- Your address

- A photo of your passport or other ID

- A selfie

Join Countingup today and discover how thousands of self-employed people benefit from the well-designed features it offers.

Find out more here and start your 3 month free trial today.