How to open a Santander business account

Table of Contents

When you’re self-employed, it’s vital to keep your business and personal finances separate to stay organised, ensure you pay the correct taxes, and generally make life easier. Santander has some free and discounted banking offers for startups, as well as accounts for charities and companies who hold money on behalf of clients.

This guide will show you how to open a Santander business account and explore other options available to sole traders and one-person limited companies. We’ll cover:

- Santander business account options

- How to open a Santander business account

- What customers think of the Santander business account

- Finding the best option for your business

- How to sign up for a business account in minutes

Santander business account options

For small businesses, sole traders, startups and charities, Santander Bank has a few options to choose from, which are as follows:

1|2|3 Business Current Account

For small businesses and startups that don’t mind paying a little extra for added features, the 1|2|3 Business Current Account could be a good option. The standard monthly fee is £12, but Santander also offers a discounted rate of £5/month for startups in their first year of trading.

Other features include:

- Unlimited Santander ATM cash deposits

- Up to £300 cashback each year

- Interest on your credit balance

- Arranged overdraft of 5.10% EAR (variable). Annual fee 1% of the agreed overdraft (minimum fee £50)

- Access online, at Santander ATMs and Post Office branches

Business Current Account

If you’re on the hunt for a more basic business current account that costs less, Santander also has a standard Business Current Account. This one costs £7.50 per month and offers 18 months free for startups in their first year of trading.

Other features include:

- No charge for cash deposits at Santander ATMs and post office branches up to £1,000 per month, then 70p per £100

- No interest on your credit balances

- Arranged overdraft of 5.10% EAR (variable). Annual fee 1% of the agreed overdraft (minimum fee £50)

- Access online, at Santander ATMs and Post Office branches

Treasurer’s Current Account

The Treasurer’s Current Account might be a good option if you run a small charity or club and don’t make more annually than £250,000.

This account offers:

- Free day-to-day banking for clubs, societies and charities

- Text and email alerts to help you manage your account

- Secure online and mobile banking 24/7

- Santander international business banking

How to open a Santander business account

At the moment, Santander Bank only accepts applications from existing customers, so you’ll need to find another solution if you’re not already a user. But, if you have a Santander bank account, you can transfer it to a business current account by following these steps:

- Log on to Online Banking

- Go to ‘Apply online’ on the right-hand side and click on ‘Transfer current account’

- Have your existing account details to hand

When you transfer your existing Santander business current account, you’ll keep your existing account number, card, and PIN. While creating an account is simple when you’re already a customer, consider your options to ensure you get the best solution for your needs.

What customers think of the Santander business account

Santander Bank has mixed reviews online, and the app appears to be the most popular with customers. As for the service offer, customer opinions vary, with some praising helpful and efficient staff and others complaining about mishandling:

- On Trustpilot, Santander Bank has 1.4 out of 5 stars and a rating of “Bad”, based on more than 3,000 reviews.

- Santander’s banking app has 4.1 out of 5 stars in Google’s Play store, based on more than 120,000 reviews.

- The app has 4.8 out of 5 stars on the App Store, based on more than 800,000 reviews.

Find the best business account for your business

While Santander Bank does offer solutions from small and medium businesses, it might not be the best option for self-employed and sole traders. Overlooking the fact that only existing customers can apply for a Santander business account, you can also find better value solutions elsewhere. In addition, the application can take a few days to process.

When running your business alone, it’s essential to find a business current account provider that gives you everything you need to manage your finances. If you’ve decided that a Santander account is not for you, other providers will meet your requirements.

If you operate as a sole trader or run a limited company alone, a challenger like Countingup might be a better option for your one-person business.

Why the Countingup business account will give you the best value

Running a business solo means you’re the director, marketing and sales manager, bookkeeper, client relationship manager and more, all rolled into one.

With many different priorities to address, the Countingup business current account is the perfect solution to save time on financial admin.

More than the basic business current account offered by Santander, Countingup is a unique two-in-one business current account and accounting software that automates the time-consuming aspects of bookkeeping and taxes. Over 40,000 UK business owners have used it to keep their finances on the right track.

The easy to use simple app gives you a live view of your business performance, including up-to-date and accurate cash flow reports. Easy access to these insights means you can track how your business is doing at any time and make adjustments when necessary.

What customers think about the Countingup app

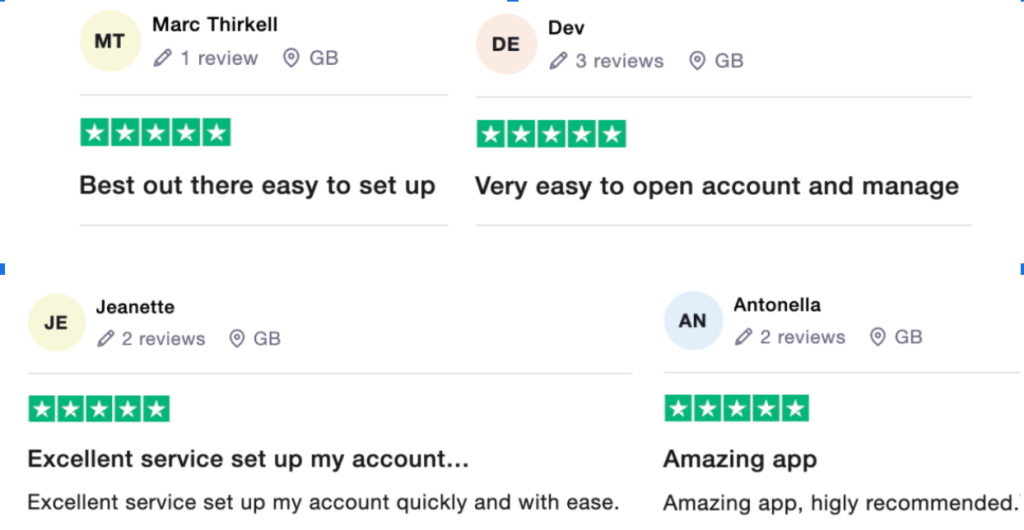

Countingup has a high score of 4.6 out of 5 stars on Trustpilot, with most people rating it as “Excellent”.

Customers praise how easy the Countingup app is to use and rave about the customer service.

Users also love how easy it is to sign up to become a user.

Sign up for a Countingup business account online in minutes

Countingup has made every effort to make the application process as quick and simple as possible. You simply need to download the Countingup app on your phone to sign up in minutes!

You typically only need to provide:

- Your name

- Your address

- A photo of your passport or other ID

- A selfie

This means you can apply for a Countingup business account when you’re on the go as long as you have this information on you.

Join thousands of business owners in the Countingup community Countingup users and start using discover a faster, more cost-effective, and efficient way to manage your finances.

Find out more here.