How to set sales goals

Table of Contents

Want to make manageable and achievable sales goals for your business?

Find out how to set sales goals and create reliable income streams to grow your business with. Read this guide to discover:

- How to set sales goals

- How to adjust your sales for seasonal peaks

- How to improve your sales goals

- How to manage your business with Countingup

How to set sales goals

Before you begin to set sales goals for your business, make sure you calculate any costs and averages using the same unit of time throughout — for example, averages per week or totals per month.

This will make sure your business is consistently meeting necessary expenses. Your sales goals will be wrong if you use expense figures from monthly bills, weekly product orders and daily customer traffic all in the same calculation.

Step 1: Calculate your total expenses

Calculating your business’ total expenses will vary slightly depending on whether your business sells products or offers services. However, the basic principle is the same for each business type.

Calculating these expenses will make sure your sales target covers necessary costs for your business so you don’t lose money.

Cost of goods

If your business makes a product, add all the relevant costs together like raw materials, packaging, operating costs for any machinery and labour during production. If your business instead retails products, your cost of goods will be the price of your inventory orders.

As a service business, your ‘goods’ are primarily the time and skill you provide to customers. However, you may also rely on some products to complete jobs. For example, as a construction or maintenance business, you’ll have various material costs per job. Therefore, find out what necessary costs you have per job on average and create a total figure.

Other overheads and operating expenses

Businesses have other costs that go into making their sales possible. For example, you may have rental costs for your business premises, operating costs like electricity and gas, or website hosting. Add these additional costs to your total expenses and make sure your sales goal covers the necessary costs for your business.

Step 2: Divide your expenses by your average customer traffic

From your market research, how many customers do you expect to interact with your business per week or month? 10? 500?

Does your business have high customer traffic but low profit, like a shopping centre kiosk or coffee shop? Or do you work with fewer clients over a long period but at typically higher profit margins, like software developers or luxury goods retailers?

Customer traffic to your business will vary depending on a number of factors such as weather and seasonal changes, evolving customer trends and your advertising strategy. If you’re completely new to business, getting an idea of your average customer numbers may be difficult, so try to research the customer traffic of any close competitors you have.

Step 3: Add your desired profit margin

The figure you’ve just calculated using steps 1 and 2 will give you a minimum sales goal: a value that each customer must spend, on average, for your business to meet its basic expenses.

With this established minimum, you can add a profit margin. This is where your take-home income comes from and can be used to grow your business further. Adding a profit margin is also essential to protect your business from sudden price increases or unexpected costs. Be sure to try our simple profit margin calculator.

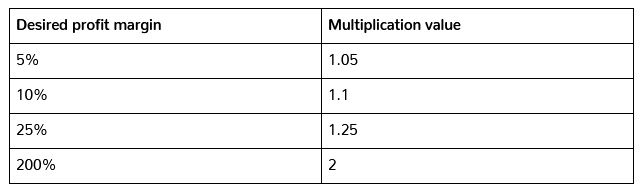

Industries operate at very different profit margins, so whether you’re able to mark up your goods by an impressive 200% or a thinner 10% will depend on your specific business.

For your business’ profit margin, take the figure you calculated (your minimum sales goal) and multiply it by your margin’s value. Such as:

This new figure now allows you to aim for a sales goal per customer (based on the average number of customers you expect to interact with your business).

As you’re looking to choose a profit margin, consider whether the final price you calculate is reasonable for the customer. In reality, your goods are only as valuable as what your customers think. Therefore, find the right balance between charging a high margin to enjoy and a low rate that’s reasonable to the customer.

How to adjust your sales to seasonal peaks

Not every business has consistent sales. You may find your customer traffic is variable across the year or between different weeks of the month.

Adjusting your sales to seasonable peaks will involve changing the average customer traffic number in step 2. If you know you have busier periods later in the month or year, look to reduce expenses and decrease your sales goal to cover your costs. This can help your business survive to a later point in time where you can make most or all of your profit.

If you’re new to business, this can be difficult. Use your market research as best you can and try to identify changes or spending patterns made by customers over time.

How to improve your sales goals

If you’re struggling to meet your sales goals, there are a number of things you can try:

- Aim to sell more items per customer or prioritise sales of higher-margin items

- Lower your desired profit margin and offer more value to customers

- Use effective marketing strategies to invite more customer interest

- Listen to customer feedback and improve your product/service

- Invest in your business to reduce costs and be more efficient

How to manage your business with Countingup

Reaching sales goals and managing a business takes time, but too often, so do other parts of new businesses

Consider using the Countingup app to save time and stress over your bookkeeping and financial admin.

The Countingup app is your business account and accounting software in one place.

Countingup provides you with automated invoicing and expense categorisation to ensure your accounts are always up to date and an innovative receipt capture tool to record new purchases on the go easily.

Find out how well your sales goals are being met with Countingup’s real-time profit and loss reports and understand what’s happening with your business at a glance.

Find out more here and sign up today.