What is net profit?

Table of Contents

2019 ONS figures reported just under 400,000 new businesses in the UK, but the 5-year survival rate of these new arrivals is less than 50%. Within this harsh business environment, finding ways to maximise your profits early on is crucial.

‘Profit’ is categorised in two different ways: gross and net. Net profit (or net profit margins) is typically the more important one, but why?

In this article, we’ll discuss:

- What is net profit?

- What is it used for?

- How is net profit calculated?

- How can I maximise it?

- How Countingup can help you understand your net profit

Whether you’re a sole trader or you’ve just launched an exciting new small business venture, read on to discover how Countingup can help you maximise your net profit.

What is net profit?

Net profit is the amount of money that is left over after all your expenses have been accounted for. Typically, net profit is a percentage that tells you, for every £1 a customer spends, how much is left for you. Net profit can also be a value in pounds and pence, depending on the context. In the next section, we’ll show you how to calculate it.

While net and gross profit are both figures of profit measurement, net profit takes into account your operating costs (like rent, utilities or website hosting). That’s why lenders and investors prefer using this figure when considering your business’ health and long-term viability and why you should too. Discover how to correctly expense your operating costs in our guide What are Operating Expenses?

What is net profit used for?

Net profit is important because it gives you a final figure to work with. Whether you’re looking to invest in new marketing strategies or in product development, this figure lets you know how much you can invest.

If your returns are high and your profits are strong, you can invest lots of money back into your business and continue growing on your own for a longer period of time. As you continue trading, you can use changes to your net profit to inform new strategies for your growth. For example, when trying new advertising strategies to gain new sales.

However, if this number is negative or relatively low, you’re either losing money or aren’t making very much. Using your net profit, you can identify how reducing or removing different expenses can impact your final figure and decide where you can gain (or regain) the most value back for your business.

Net profit figures also offer critical for investors and lenders. Your net profits are a gauge to understand how well you’ll be able to finance loans or return investment. Therefore, understanding your net profit and how it can change is an important business tool no matter your industry.

How is net profit calculated?

Depending on the context, you might need to calculate your net profit as a number or percentage. While percentages help you compare profits from different periods (for example, month to month) at early stages, you might find working with the number itself easier because you can plan how you’ll budget it.

You can calculate your business’ net profit by combining all of your expenses (cost of goods, other expenses, taxes, and debt) and subtracting this figure from your total income:

Net profit = total income – total expenses

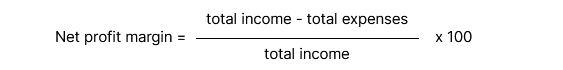

If you need this figure as a percentage instead (to find out your net profit margin), take the figure you’ve just calculated and divide it again by your income, then multiply by 100.

If you’ve found that your net profit is a negative number, your expenses are larger than your income. This can be common for many businesses at earlier stages as they set up and find a customer base. Many businesses don’t see profitability until their second year. We’ll discuss what you can do to fix this in the sections below.

How can I maximise net profit?

Steps to maximise your net profits are straightforward, but each option comes with consequences. At its core, you have to either increase revenue (by increasing customer prices, number of units sold, etc.) or decrease expenses (cutting costs of suppliers, utilities, etc.).

Knowing your business, you will be able to decide how viable certain options are over others. Here are some key factors to watch out for as you look to increase your profits:

- Sacrifice short-term profits for longer-term gains. A key milestone in any business is reaching sustainable profits, but you might have to give up profits to finance growth in your business as you trade. Balancing when to invest or keep your money and by how much will be an important and ongoing decision as you grow your business.

- Prioritise returns in your investments. Changing your marketing strategy or diversifying your product line can be risky. As you look to expand, consider the level of necessity, risk and reward of each strategy. Not every outcome is safe or highly rewarding, so understanding your investments is key to protecting and expanding your net profits.

- Minimise expenses. Certain costs can be easily reduced (like switching suppliers), while others are harder to do (like staffing). Regularly reviewing your expenses can be an effective way to reduce costs and maximise your profits while ensuring your accounts are accurate.

- Consider longer-term strategies to increase income. Many businesses find that they are only profitable at scale, so minimising expenses isn’t always viable. Here, you might find that transitioning to longer-term strategies to increase your income will improve your net profits more than short-term expense cuts.

How Countingup can help you maximise your net profit

Countingup makes managing your business easier. With your business current account and accounting software in one app, we automate the time-consuming aspects of your financial admin.

With all your important figures ready at a glance, you can quickly and easily understand how your net profit changes as you trade. Instead, you can focus on doing what you love and do best. Find out more here.