What is the single-entry system of bookkeeping?

Table of Contents

Bookkeeping is a key part of running any business. If you’re only starting out as a business owner, single-entry bookkeeping could be the quickest and easiest way to record your financial transactions.

This guide will cover:

● The single-entry system of bookkeeping and how it works

● The difference between single and double-entry bookkeeping

● The advantages and disadvantages of single-entry bookkeeping

● How Countingup can save you time on your bookkeeping

What is the single-entry system of bookkeeping?

The single-entry bookkeeping system is a method used to keep track of a company’s finances. For each transaction, you record one entry into your ‘cash book’, a journal of columns that organises transactions according to date, description, and whether it’s an expense or income.

Single-entry bookkeeping is used to record the following financial information for a business:

● Taxable income

● Tax-deductible expenses

● Cash

When recording each transaction, you either list them as positive or negative. The easiest way to keep these organised is to split revenue/income and expenses into separate columns. You always record expenses as a negative number, meaning you subtract the sum from your total balance.

Using accounting software to perform your single-entry bookkeeping can make the process easier.

Whether you use a digital or paper-based cash book; at a minimum, it must record:

● Transaction date

● Transaction description (what did you spend or make money on?)

● Transaction value

● Balance: a running tally of your cash total

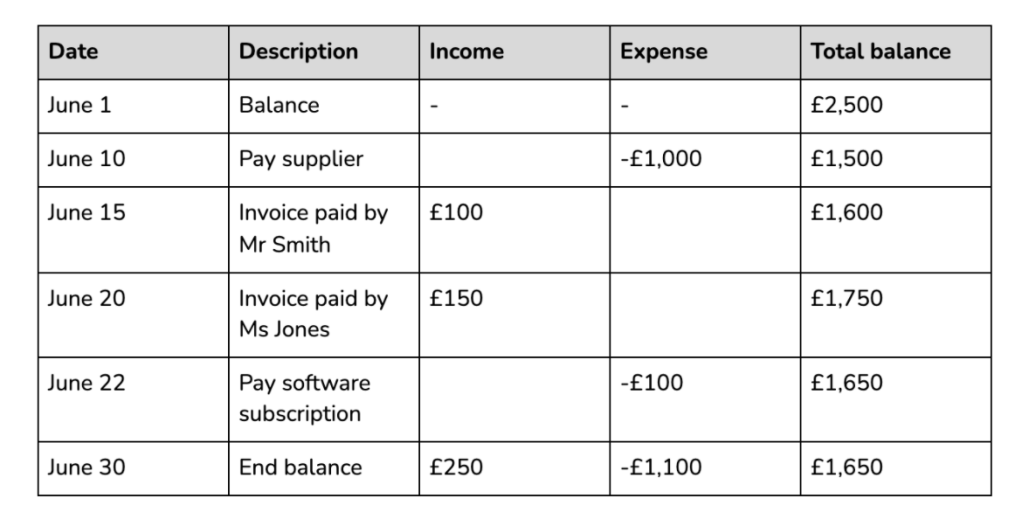

You can also add a column for notes to help you keep track of where the funds came from. The last row of the table should show the balance at the end of your accounting period, whether this is a month, a quarter or a year. In its simplest form, a cash book entry for a month could look like this:

What is the difference between single and double-entry bookkeeping?

Number of entries

The main difference is that single-entry bookkeeping only has one entry per transaction, while double-entry bookkeeping has two: a debit and a credit. Double-entry bookkeeping involves recording a debit in one account and a credit in another. Learn more about what debit and credit mean in accounting terms.

What is recorded

Single-entry bookkeeping uses cash accounting, which focuses on cash coming in (revenue) and going out (expenses). Cash accounting only records transactions when they happen, meaning when money changes hands through cash, bank transfers, wire transfers, and so on.

On the other hand, double-entry bookkeeping uses accrual accounting, which is more complicated. This method has five accounts: assets (items of value), liabilities (money you owe), equities (money you take home), revenue, and expenses. Single-entry only uses the last two.

How transactions are recorded

As we mentioned, using the single-entry bookkeeping system means you only record transactions when they happen. When money comes in, you record revenue; when you’ve paid something, you record expenses.

When companies use the double-entry system, they record revenue when they earn it, not when they receive it. In the same way, they also record an expense when it’s due, not when it’s paid.

What are the advantages of single-entry bookkeeping?

The main advantage of the single-entry bookkeeping system is that it’s simple and straightforward, so it might be the best choice if you’ve just started running your own business and don’t have much experience with accounting. Single-entry bookkeeping can also be done using a simple spreadsheet, meaning you can start recording before you set up an accounting system.

Service-based businesses sometimes prefer this method since they generally don’t have the added complication of inventory (or stock), meaning they usually have fewer transactions to keep track of.

If your business is new and has limited activity, this system gives you all the information you need. Single-entry produces your company’s income statement, also known as a profit and loss statement.

Income statements show how profitable a business is within a specific period. An income statement is an essential report for understanding your business’s finances, allowing you to see where you can make changes and improve. Single-entry bookkeeping focuses on this report and might be enough for you to monitor your finances when you’re starting out.

However, like most things in life, single-entry bookkeeping also has some drawbacks.

What are the disadvantages of single-entry bookkeeping?

Single-entry bookkeeping doesn’t include important financial accounts like accounts receivable (money owed to you), accounts payable (money you owe), or inventory. This means that you can’t use this form of bookkeeping to produce your balance sheet and cash flow statement.

As your business becomes more active, you need your income statement, balance sheet and cash flow statement to get a complete view of your business finances.

Another disadvantage of the single-entry bookkeeping system is that it’s more difficult to track your liabilities and assets. This is because even money you don’t yet have (like accounts receivable) counts as an asset, while debts you haven’t paid yet count as liabilities.

For example, if you take out a business loan, single-entry bookkeeping records it as income. However, if you used a double-entry bookkeeping system, you’d also record the loan as a liability (money you owe), which would give you a more accurate picture of your total debt.

Double-entry bookkeeping is also better at matching expenses related to producing your product or service with its related payment. If the expense and payment happen in different accounting periods (perhaps if you sent the invoice at the end of the month), a single-entry system can’t match the two up.

Finally, single-entry bookkeeping makes it harder to spot errors or identify fraud in your accounting. Since debits and credits always have to match in double-entry accounting, you’ll notice if they’re out of balance. Single-entry bookkeeping doesn’t have this protection, meaning that errors could be carried forward without you noticing.

Bookkeeping can be a pain, but with the right system in place, you could shave hours off your accounting time. Find out more below.

The app that saves you time on your bookkeeping

By setting up a Countingup business current account, you’ll find it’s simple to keep organised when it comes to your bookkeeping.

The two-in-one app is made for small business owners. It comes with free built-in accounting software that automates the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business’ finances, profit and loss statements and tax estimates, as well as being able to create and send invoices in seconds.

You can also share your bookkeeping with your accountant instantly, without worrying about duplication errors, data lags or inaccuracies. Seamless, simple and straightforward!

Find out more here.