What is spend analysis, and why does it matter?

Table of Contents

When you run a small business, every expense matters. With spend analysis, the close examination of each business cost, you can improve your finances and protect your earnings.

But what is spend analysis exactly, and how might you start?

This guide covers spend analysis in business, including:

- What is spend analysis?

- Why is spend analysis important?

- How can you conduct a spend analysis?

What is spend analysis?

Spend analysis is when you collect all the data from your business expenses to reorganise, categorise, and examine it. It allows you to assess and understand your spending habits, including the how, where, and why.

With this analysis, you can turn the hard numbers into more digestible information. As a result, you’ll gain valuable insights into trends and commonalities in your spending.

3 reasons spend analysis important

Spend analysis is a critical part of understanding your spending patterns. Let’s go over what it can do for you.

Gives you a full picture

Spend analysis helps you understand where your money goes. Though you must track and record your business expenses, it can be difficult to rationalise these numbers.

But compiling the data in one place lets you examine it closely to create graphs, such as pie graphs that break you spending up by category.

Similarly, line graphs show increases or decreases in spending over different categories, making it easier to visualise. Numbers just make more sense when you turn them into a graph, don’t they?

With your information organised into visuals, you’ll gain a comprehensive understanding of where you spend money and why.

For example, you could:

- Assess wasteful spending and cost-cutting opportunities by flagging where you spend the most money and which costs lead to the least revenue

- Measure the functionality of your supplier relationship by assessing costs, reliability, and timeliness of orders

- Find chances to streamline operational processes for greater cost-efficiency by looking at where you might invest in a new tool or combine tasks to save money in the long run

- Flag accidental or forgotten automatic spending (such as unused or forgotten subscriptions) by taking a closer look at transaction records

- Develop more realistic budgets, financial forecasting, and money goals by strengthening your grasp on what you spend and how it changes over time

Answer valuable questions

The analysis does more than just total up your spending. It answers critical questions about your expenses, such as:

- What did you buy?

- Who did you give money to?

- How often do you spend money on specific things?

- How much did you spend on particular expenses?

- Did you see the expected return from that expense?

With these questions, you can uncover the reasoning behind transactions and measure if those expenses were worth it.

Help you make better decisions and cut costs

Conducting a spend analysis confirms how successful your spending is. Plus, you’ll catch any unnecessary or wasteful costs that don’t help your business or create revenue.

Doing so helps you cut costs and make future decisions that promote financial growth. Plus, it allows you to create guidelines for the future. As a result, you’ll increase and retain more revenue.

How to analyse your spend

Now that you know what spend analysis is and why it’s important, think about conducting to better grasp your small business finances. We’ll show you how.

Find data sources

To conduct a spend analysis well, you’ll need to collect transactions. Look to wherever you charge or record your business expenses, such as:

- Your bookkeeping

- Your business account bank statements

- A business credit card

Compile and check the data

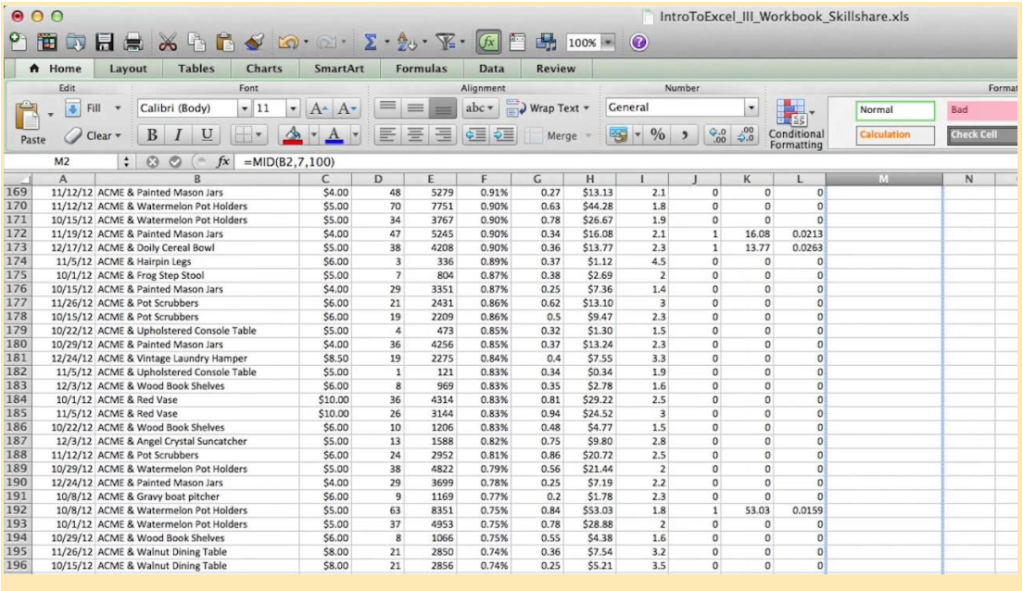

Next, compile your information into a spreadsheet so you can work with it in one place. Be sure to stick to a time frame for a clear picture, such as the last quarter or financial year.

As you record expenses, be sure to include:

- What – what you bought

- Why – purchase purpose

- When – date of purchase

- Who – who you purchased from

Then, check the information for errors, omissions, or repeats. The insights in your analysis are only as useful as the data itself. So, it’s crucial to have accurate numbers.

If you organise your spreadsheet by date, it might be easier to spot repeats and find missing pieces (see below).

To learn more, check out this video on how to clean up raw data in Excel.

Organise the data

Organise your collected spending data to find patterns and trends.

To do this, separate your expenses into categories, such as:

- Supply and inventory

- Marketing and advertising

- IT

- Transport, travel, and fuel

- Maintenance

- Utilities

Of course, you could also create unique spending categories that make more sense for your business.

Analyse the data

Separating your expenses into categories helps you analyse them efficiently. At this point, you can create infographics, tables, and graphs that tell a story with the numbers.

For example, you might break your spending up with a pie chart to look at how much you spend in each category. Or you could use a bar chart to break your spending up by year and measure growth.

Guide your analysis with driving questions about your finances. For example, you may want to know how much your spending has increased over the last year and in what categories it grew the most.

Use tools to simplify the process

Modern accounting software

Tools like Countingup can help you compile and organise your data more efficiently.

Countingup is the business current account and accounting software in one app. It automates time-consuming bookkeeping admin for thousands of self-employed people across the UK.

It can simplify your spend analysis with the automatic expense categorisation tool, taking some of the labour out of organising your expenses.

Start your three-month free trial today.

Spend analysis tools

Also, consider using a tool that analyses spending data for you, like Proactis.

When you add your data to the platform, it can seamlessly categorise it and offer valuable insights. Plus, the automated tool develops quicker and more accurate conclusions.

Set objectives

The main purpose of spend analysis is to form objectives that will improve your business. How would you like to alter your future behaviour based on the analysis?

Try coming out of your spend analysis with a few realistic objectives. For instance, you might want to reduce expenses by 5%, particularly in marketing.

Or you could notice your supplier has increased prices, added hidden fees, and delivered late. In this case, try seeking a new and more affordable supplier for your business.

Update the analysis

Analysing your spending increases visibility. But it’s important to repeat the process for maximum impact. So, schedule an analysis once a year to check your habits and track your objectives.

Strengthen your analysis and your finances

Knowing what spend analysis is and how you can use it will help you plan better finances. As you compile and organise your spending data, your findings might make you wonder about other aspects of your financial activities.

Focusing on financial planning can help improve your business. So, consider checking out these articles next: