3 types of financial reporting every small business needs

Table of Contents

As a business owner with little time, you’ll want to know what financial records are the most important to your small business. This article will look at the following areas, including three types of financial reporting you need to be using and how to do so:

- Why you need financial reporting

- Report 1: Balance sheet

- Report 2: Profit and loss statement (income)

- Report 3: Cash flow statement

- Making financial reporting easier with Countingup

Why you need financial reporting

Financial reports can reveal a lot about how your business is run and how it can be improved. There are many reasons why you need to keep financial reports, including:

- Tax purposes. It’s mandatory to have financial records when filling in a self-assessment tax return, so keeping effective reports will make it easier when you have to provide proof of income.

- Proving the financial state of your business. If you need funding then you will have to provide detailed financial records to potential investors.

- To improve your business. Understanding your finances will help you make more informed decisions about growth and improving every day operations.

So what are the main types of financial reporting that you can use as a small business owner to keep on top of your money? We’ll look at three to get you started.

1) Balance sheet

Simply put, the balance sheet is a two sided chart that lists on one side the value of what you owe, and on the other shows what you own. The total of each side should come to the same amount to show if your business is financially stable or not.

The following formula determines the balance sheet:

Assets = liabilities + owner’s equity

Let’s look at the terms. Your assets are items or things that your business owns. This can range from machinery, vehicles, stock, furniture and cash in the bank, to smaller items like a fancy coffee machine or office supplies. Assets are items that add value to your business.

Liabilities are what you owe other parties or companies. This could be a bank loan, a mortgage on a business property, suppliers fees, taxes you owe HMRC or wages if you have an employee.

Owner’s equity is how much of the assets you own – if you are the sole owner of the business then this will be an easy calculation. Once you have totalled up your entire assets and liabilities, subtract the liabilities from the assets and you have the owner’s equity figure. This calculation basically shows what would be left over if all assets were sold and all debts were paid.

So to put this into a balance sheet, you’d add your Assets on one side of a table, and your Liabilities and Equity on the other – and as the name suggests, the totals should balance.

Let’s use a hairdresser as an example.

If your totals don’t balance, you need to double check your figures or understand where extra debt or assets have appeared in your finances.

2) Profit and loss statement (income)

A profit and loss statement (often also called an income statement) shows all your ingoings and outgoings. This statement will show you what your bottom line, or net income, is and if you have made or lost money over a period of time.

It’s crucial to get a profit and loss statement correct as you are taxed on your net income. Your expenses will also be subtracted from your tax bill, so it’s an important document for both yourself and HMRC.

How to prepare a profit and loss statement

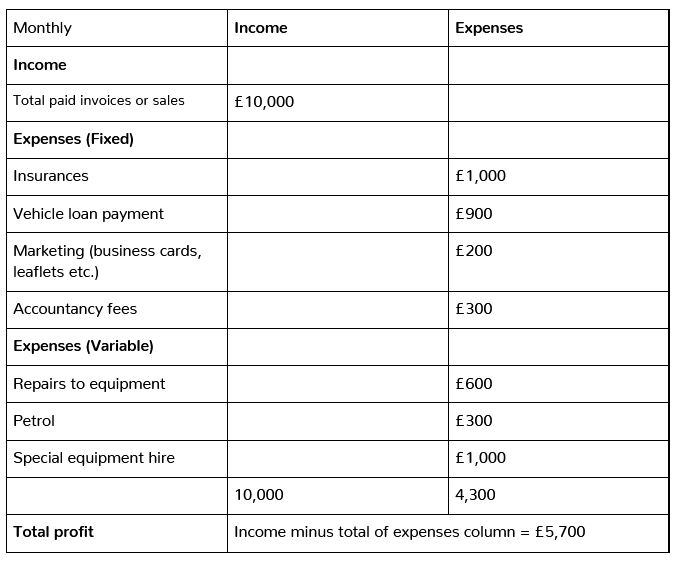

First, you need to list any sources of income in one column and any spending in another. Use a new row for every cost so that there is no confusion between the totals or receipts that you might need to keep.

In your expenses, it is wise to split this into variable costs (final amounts that change all the time, such as bills, ad-hoc repairs or maintenance, or petrol costs) and fixed costs (like financial payments, insurance premiums, suppliers fees) so the records are organised.

Let’s use a self-employed garden landscaper as an example this time.

This shows a net income of £5,700 for that month. If you are interested in working out your profit margin %, then use our profit margin calculator.

3) Cash flow statement

A cash flow statement shows all incoming and outgoing transactions over a period of time. It gives an indication of the financial health of your business and can highlight issues so that you can create plans for how to solve them. For example, you might be doing a lot of business with several clients, but if they are slow to pay their invoices you may not be able to pay your other financial obligations. A cash flow statement could help you identify this bottleneck preventing cash flowing in and act upon it.

The cash flow statement provides a more detailed view of how your money is being spent, and in what areas. The profit and loss statement, on the other hand, works out the net profit you’ve gained (and the cash flow statement needs the net profit total to be included),

If you are looking for funding, a potential investor will be very interested in the cash flow statement. It will help them understand where you are spending your money as it shows how the business operates. You’ll need to prepare figures in the following three areas:

- Operations: the payments you need to make to continue trading, including suppliers, stock costs, or potentially shipping charges if you are product-based. If you are a service-based business, this could include wages, equipment or software costs.

- Investing: this covers money invested in items that benefit the value of the business, such as buying more sophisticated equipment or buying or selling assets (physical or intangible).

- Financing: this includes payments made that are to cover any debts, including repaying loans or invoicing for services.

We have a more detailed article on how to prepare your cash flow statement, which you can read here. Once you have compiled all your figures and have a statement (in a similar way to the profit and loss statement), a negative cash flow will indicate that you lost money in that time period, while a positive cash flow will show that you had money to spare.

Save time on financial admin with Countingup

Countingup is the unique business current account and accounting software in one app that automates the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business finances, profit and loss statements, tax estimates and create invoices in seconds.

All these and many more features will help you keep organised when it comes to your finances and allow you to operate more efficiently. To start saving yourself hours of accounting admin, find out more here.