What can nurses claim on uniform expenses?

Table of Contents

If you’re a self-employed nurse, you may qualify for certain tax relief on your income. Find out how much you can claim for uniform and laundry expenses in this article.

We’ll cover the two main ways in which self-employed nurses are eligible for tax relief, whether you work in the NHS as agency bank staff or at a private hospital or nursing home.

In this guide, discover:

- What nurses can claim through the flat rate

- What nurses can claim if they’re self-employed

- How to claim on your uniform and laundry expenses

- What you’ll need to have for a successful expense claim

- How to track your expenses more efficiently with Countingup

What nurses can claim through the flat rate

Nursing professionals often secure work through agencies but can be self-employed for tax purposes. Similarly, some nurses have launched small private practices and operate as sole traders to address the labour gap in recent years. If either one of these examples applies to you, you’ll want to know what you can claim back as expenses from your taxes.

You may be eligible for a flat rate of expenses to help cover key costs associated with your job. Flat rate tax relief covers three main aspects of the nursing profession, however, you will need to confirm with your agency to see if you qualify for this specific tax benefit. If you don’t, you can skip ahead to the next section where we cover uniform expenses more broadly for self-employed nurses.

Laundering uniforms and work clothing

Flat rate expenses for laundering costs are currently calculated at £125. This covers around £2.60 per week for laundering expenses for you to use (after statutory holiday deductions).

However, this laundering allowance is only given to nurses if they must launder their own clothes. This is because some wards and hospitals have on-site laundering facilities and it is presumed that nurses and staff can use them for work-related clothing.

Therefore, you will need to confirm whether you’re able to use these facilities for your uniform and deduct the flat rate of laundry expenses as appropriate from your taxes.

Shoes and tights or stockings

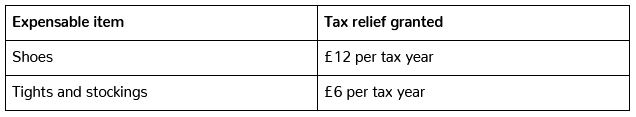

Nurses are also eligible for tax relief up to the cost of £18 for shoes and tights or stockings as part of their job. This is broken down into the following:

This is provided to help cover replacement costs for these items, however, it’s only allowed for these specific items as other clothing items like jewellery or undergarments don’t qualify.

What you can claim as a self-employed nurse

If you don’t qualify for the flat rate on your uniform costs, you may still be eligible for tax relief if you’re a self-employed nurse. This is because, as a healthcare professional, you will likely have some sort of work clothing for routine patient care – as before, these might be items like scrubs, nursing tunics and shoes.

You can claim back these clothing expenses on your Self Assessment as they are related to your job. However, any expense claim must be related to the maintenance of a uniform or protective clothing for your work. This is because you can’t claim on personal clothing that’s part of your everyday life, even if you also wear it while working. Again, this may rule out certain undergarment items and jewellery.

Therefore, in order to simplify your tax claims, it may be best practice to have a set of clothing and shoes you only wear for work purposes.

How to claim on your uniform and laundry expenses

When claiming, add up all your allowable expenses for the tax year and put the total amount on your Self Assessment tax return. You’ll need to record or accurately estimate how much you spend on uniform and laundry costs so you reimburse yourself the proper amount and no more.

Fortunately, you don’t need to send in proof of your expenses (like receipts) when submitting your tax return, but you are required to keep any records for up to five years. This means you should have all relevant records available for HMRC if asked.

What you’ll need to have for a successful expense claim

Claims to HMRC are successful when you have reasonable expenditure and keep accurate records. Therefore, you should keep a running record of receipts across the financial year.

However, from 6 April 2023, you’ll need to keep all business records digitally using accounting software like Countingup. This is part of HMRC’s Making Tax Digital initiative to simplify taxes for self-employed people and make the filing process easier.

If you’d like to find out more, read our article What is Making Tax Digital (MTD)? where we explain more about how MTD will affect self-employed people in the very near future.

How to manage your expenses more efficiently with Countingup

When you sign up for a Countingup business current account, you get free MTD-compliant accounting software that allows you to manage your business’ finances with ease. This means you’re covered before the deadline begins and you can start tracking your expenses more efficiently.

Countingup automates bookkeeping admin with automatic expense categorisation, notifications for you to capture receipts as you make transactions and instant invoicing. These features work together to make sure your records are always up today and accurate. Countingup also provides running tax estimates on your income so that you know exactly how much to set aside ahead of the Self Assessment deadline.

Find out more here and sign up for free today.