MTD: When is the right time to prepare your ‘once a year’ clients?

Table of Contents

Accountants may only have three chances to introduce clients to MTD

On 21 July 2020, HMRC announced the next stages of the Making Tax Digital (MTD) project. The most significant news was the expansion of MTD rules to Income Tax: Self-employed businesses and landlords with annual business or property income above £10,000 will need to follow the MTD rules from their accounting period starting on or after 6 April 2023. An estimated six million taxpayers will need to comply with MTD for Income Tax.

Many taxpayers brought within the MTD rules by this announcement will fall into the “once a year” client category; they only engage with their accountant at the end of their tax year to get their final accounts prepared (and filed at Companies House), tax returns produced and filed.

This means that accountants may only have three chances – tax returns pending 31 January 2021, 2022 and 2023 – to speak with many of their self-employed and landlord clients about MTD before it becomes compulsory.

For the clients who habitually leave it late to share their records, leaving these conversations until January 2023 won’t give much opportunity to migrate them to an MTD compliant software product – let alone train them to use it properly.

When is the right time to prepare clients for MTD?

While it may seem that there is plenty of time, it will be important to have a structured plan in place for a smooth, manageable transition.

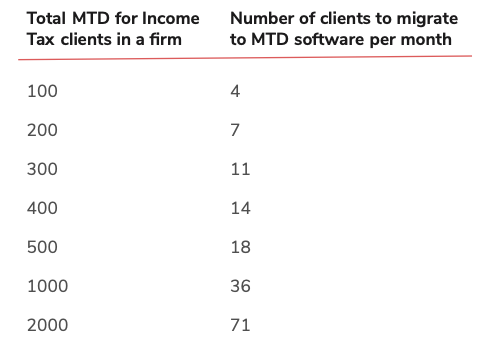

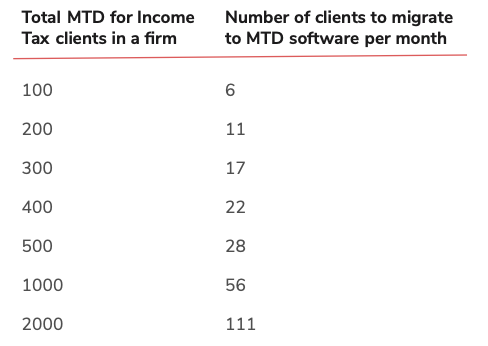

Depending on the number of clients you have, the tables below show how many you may want to onboard each month to make sure each is compliant for MTD for Income Tax before the deadline:

28 month MTD plan starting December 2020

18 month MTD plan starting May 2021

The tables above highlight the amount of attention needed for an MTD migration project. And if a firm with 200 self-employed or landlord clients left it until October 2022 to start migrating these clients, it would need to migrate at least 33 clients per month at the same time as handling 31 January 2023 Self-Assessment returns. For a firm of this size, this may well prove to be beyond the resources of their team – which is why it’s so important to start planning for MTD sooner rather than later.

With a bit of forward planning, designing and implementing a plan to help your clients become MTD-compliant doesn’t have to be stressful or time consuming. Countingup, the free accounting software built for practices with sole trader and self-employed clients, is making MTD migration simple and helping practices become more efficient and profitable.

We are working with accountants to design and implement successful MTD migration projects. To have a conversation with one of our MTD specialists, schedule a call with us today.

Find out how thousands of practices are improving efficiencies with Countingup.