Invoicing for small specialised construction businesses and contractors

Table of Contents

Small construction businesses and contractors face many challenges when trying to stay afloat amongst economic uncertainty, changing regulations and market sensitivity. The construction sector has one of the highest levels of business failure, compared to other industries, with 3,077 construction firms closing up shop last year alone.

One of the biggest causes of company failure for construction companies is a lack of financial control and poor management. With better cash flow management, construction companies should remain operational and financially healthy.

Good cash flow management starts with understanding your finances, construction accounting practices and sending invoices, so you’re paid on time every time. Keep reading to learn more about:

- The specialist construction market

- What is a construction invoice?

- How to send a construction invoice

- Determining payment milestones

- How to avoid overbilling

- How to avoid underbilling

- Best accounting software for small construction companies

State of the industry: specialist construction market

The specialist construction market represents the bulk of the construction industry, with 2.3 million businesses working in the space in the EU, accounting for roughly 70.1% of the sector. Specialist construction covers everything that requires specialist skill sets or equipment such as building foundations, damp proofing and waterproofing, dehumidifying buildings, bricklaying and stone setting, erecting/dismantling scaffolding, and much more.

Small specialist construction companies employ 7.85 million people, with many of these individuals working as contractors or self-employed business owners.

Small, new businesses need to maintain a healthy cash flow to have the best chances of success.

What is a construction invoice?

Every construction company handles invoices differently. However, generally speaking, a construction invoice is a document that a contractor, subcontractor or supplier provides to request payment for the work performed. Sending an invoice establishes a payment obligation, which then, in turn, creates an account receivable and keeps the cash flowing.

Creating, sending and receiving payment on your invoice is the best way to maintain a healthy cash flow and ensure your company lasts long into the future.

How to create a construction invoice

You need to create a detailed invoice at the start of every project. Most construction companies charge a deposit to cover base costs such as materials required. As a specialist construction company, the initial deposit may be higher as you need to rent specialist equipment or source individuals with the right skillset. This initial deposit acts as a safeguard against bankruptcy. It ensures you don’t go bust if your client fails to pay (we’ll talk about the delicate balance between over and underbilling a bit later).

You’ll need to create a separate invoice for the deposit and final bill. So, it’s essential to understand the best practices for creating an invoice as a specialist contractor or small business.

What to include on a construction invoice

To get paid on time, it’s essential to include all the right information on your invoice. Most construction invoices should include the following information:

- Invoice date

- Your name and address

- Clients’ name and address

- Unique invoice number

- Details of the goods or services provided

- Amount due (including VAT)

- Payment terms, due date and details

You may need to include additional information for specialist projects.

Invoice

Businesses deal with a vast amount of paperwork in the construction industry — everything from purchase orders to receipts. So, it’s essential to mark your invoice as an invoice in large, bold font in the header.

Your business details

You need to list your company’s contact details (name, address, email address, and phone number) so the person processing the payment can contact you if there are any questions or issues. You may also want to include your company’s logo (if you have one) on the invoice.

Client’ details

Underneath the header, you want to include your clients’ contact details and your main point of contact. Before you send your invoice, ask the client for the best point of contact. Large companies with dedicated billing departments may need to have this point of contact sign off on the purchase before it can be processed, so not including this information could cause delays.

Unique invoice number

Many clients will use the unique invoice number as a reference number on your payment. This helps them track which invoices have been paid and also makes it easy for you to recognise incoming payments, especially if the clients’ bank account name is different from their trading name.

You can keep this simple by numbering your invoices, starting with #001 and working up.

Description of the services provided

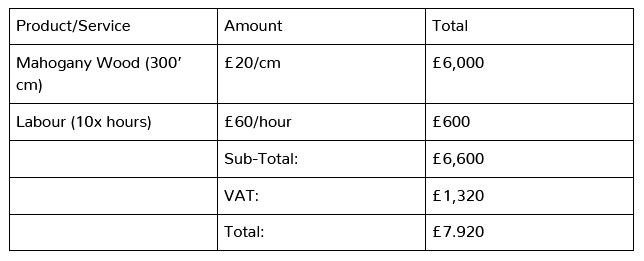

You also need to provide a detailed description of the services or materials supplied. For a specialist construction business, you may choose to bill the materials separately from the labour. Say, for example, the client requested a specific, expensive type of wood to be used to build their countertop. You might bill for this separately, so you’d have the following*:

*Prices are fictional and are only used as an example.

VAT

How much VAT you’ll need to charge will largely depend on who you’re invoicing and whether you’re working as a subcontractor under the Construction Industry Scheme (see VAT reverse charge below).

Most construction work, including plumbing, plastering and carpentry work, has the standard VAT rate of 20%, but there are some exceptions. For example, you may not need to charge VAT if you’re building a new house or flat or carrying out work for disabled people in their home. You may also need to charge a reduced VAT rate of 5% for work like installing energy-saving products, conducting work for people over 60, converting a building into a house or flats, renovating an empty house or flat or home improvement on the Isle of Man.

Reverse charge VAT

The UK government has also recently launched a new initiative for VAT reverse charge for supplies of building and construction services. This new legislation applies from March 1st 2021, and is an extension of the Construction Industry Scheme (CIS).

Under this new regulation, companies that supply construction services to VAT-registered customers don’t account for VAT. Most businesses and contractors will be VAT registered, while individuals and homeowners won’t be.

Total amount due

Once you’ve added VAT, you then need to include the total amount due. It’s essential to add a unique colour or bold the total amount to make it stand out.

Payment terms

You also need to include payment terms on your invoice. Most construction invoices have payment terms of net 30 days, which means the invoice is due 30 days after the invoice date. Setting shorter payment terms can help with your cash flow or, at the very least, allow you to start chasing for the late invoice sooner.

You may also want to include details of a late payment policy, like standard interest rates.

Payment date

Alongside the payment terms, you also want to state when the invoice is due. Try to be as specific as possible to avoid any confusion; for example, ‘Payment due September 1st 2021.’ Having a clear end date will also make it easier to chase clients if it isn’t paid on time.

Payment details

You’ll also need to provide clear information about how you’d like to receive your payment. If it’s an international payment, you may need to provide different details like an IBAN or BIC.

Determine payment milestones

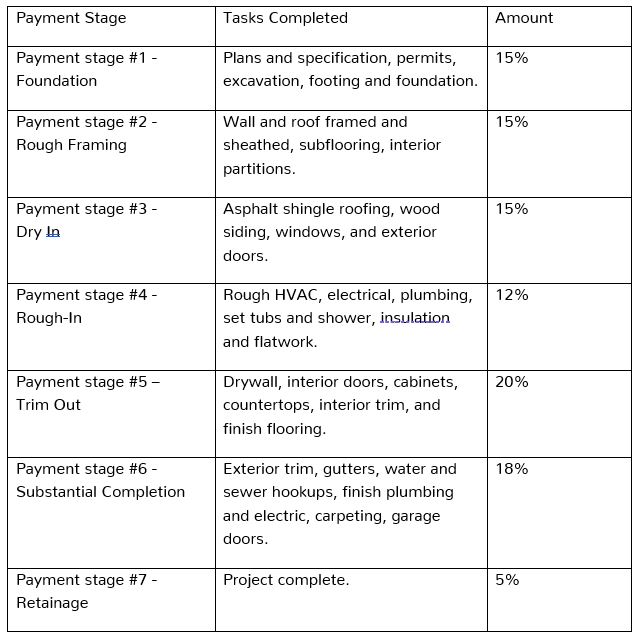

Payment milestones, also known as payment stages or schedules, allow companies to regulate their cash flow better and minimise their risk. They can be quite a good idea for longer projects as you’ll be paid throughout rather than having to wait till the project has been completed.

You’ll need to set out and agree on payment milestones in advance and set out in the signed contract. These stages are likely to vary depending on the project’s scope and should be marked against precise tasks. For example, a payment schedule for a customer-financed home or addition may look like this:

If your client or customer fails to pay at any stage, you can then stop all work till you’ve received the payment. This minimises your risk and ensures you get paid throughout.

Overbilling

Overbilling is the practice of billing for contracted labour and materials before the work has been completed. For example, the contractor may have only completed 20% of a project but invoices for 30% of the work. The extra 10% is considered the overbilled amount.

On the one hand, overbilling ensures you receive payment before you start work, which can be a good thing, especially in the construction industry, which is notorious for late payments. Overbilling allows contractors and small businesses to stay ahead of the project cash flow and avoid the negative impact of delayed impact. As a result, this practice is relatively common in the construction industry.

However, overbilling can also create issues, especially if you experience scope creeps such as extended project timelines. If you’ve gotten too far ahead in progress billings, it’ll be difficult to backtrack and increase the overall charge to avoid running out of funds.

Under billing

Under billing is the exact opposite of overbilling and happens when a contractor falls behind on the billing cycle. You don’t invoice for the total amount of work completed. Say, for example, you complete 30% of the project, but only bill for 20% — the 10% difference would then be the under billed amount.

Under billing is bad news for you and your business as you’ve invested money or time into the project but haven’t been compensated. Or, in other words, you’re spending money without receiving the corresponding revenue, which will eventually cause you to run out of funds entirely (even if only temporarily).

Under billing typically happens as contractors are so busy completing the work that they don’t get around to sending the invoices till much later. Accounting software can help solve this problem by making the process of creating invoices quick and easy.

Best accounting software for small construction companies

Accounting software can help solve many of the cash flow problems faced by specialist construction businesses and contractors. The best accounting software for small construction companies will make it straightforward and easy to create, send and receive payments.

How Countingup can help your construction business

With Countingup, you can apply for a business current account online in minutes and for free. It automates the time-consuming aspects of financial admin, saving thousands of UK business owners time and money. Find out more here.