Invoice as a self-employed cleaner – with template

Table of Contents

As a self-employed cleaner, like with any other service, you deserve payment for your work. Invoicing is a vital part of ensuring that happens. Creating and sending invoices to clients ensures you can get paid.

This guide will explain why you need to invoice as a self-employed cleaner and how you can start, including:

- What is invoicing?

- Why do I need to invoice?

- How do I create an invoice? (self-employed cleaner invoice template)

- How can Countingup make invoicing easier for me?

What is invoicing?

Invoicing is considered as a time-stamped document that records a transaction between a buyer and seller. For your cleaning, it means that when you have completed a job, you can provide a list of services you did and how much you expect clients to pay.

The crucial part of an invoice is that both the seller and buyer are aware of the transaction and its terms. For example, outline what action you would take if there is a late payment (e.g. 10% charge for every month unpaid).

Why do I need to invoice?

If you or your client is VAT registered then invoicing is required by law. Clients may be unable to pay for your services without an invoice. To make a payment, many need to seek approval from management or document the invoice in their accounts. Even customers who are not representing businesses may be more comfortable paying for an invoice’s service.

It is a fine piece of evidence for a service you provided for you and a documented expense for them. Invoices also help you measure the success of a business. You can use your invoices to record the services you have provided and the prices you have charged. It allows you to plan further ahead for your business, with options for bookkeeping and accounting.

An invoice also provides you with some much-needed protection as a self-employed cleaner. You can use invoices as a record of work. For example, the invoice can mention how long each service took. Also, if a client tries to make legal action claiming for uncompleted work, an invoice would help contest that. Even more, you can use an invoice to take legal action against a client if they fail to pay for finished work.

How do I create an invoice? (self-employed cleaner invoice template)

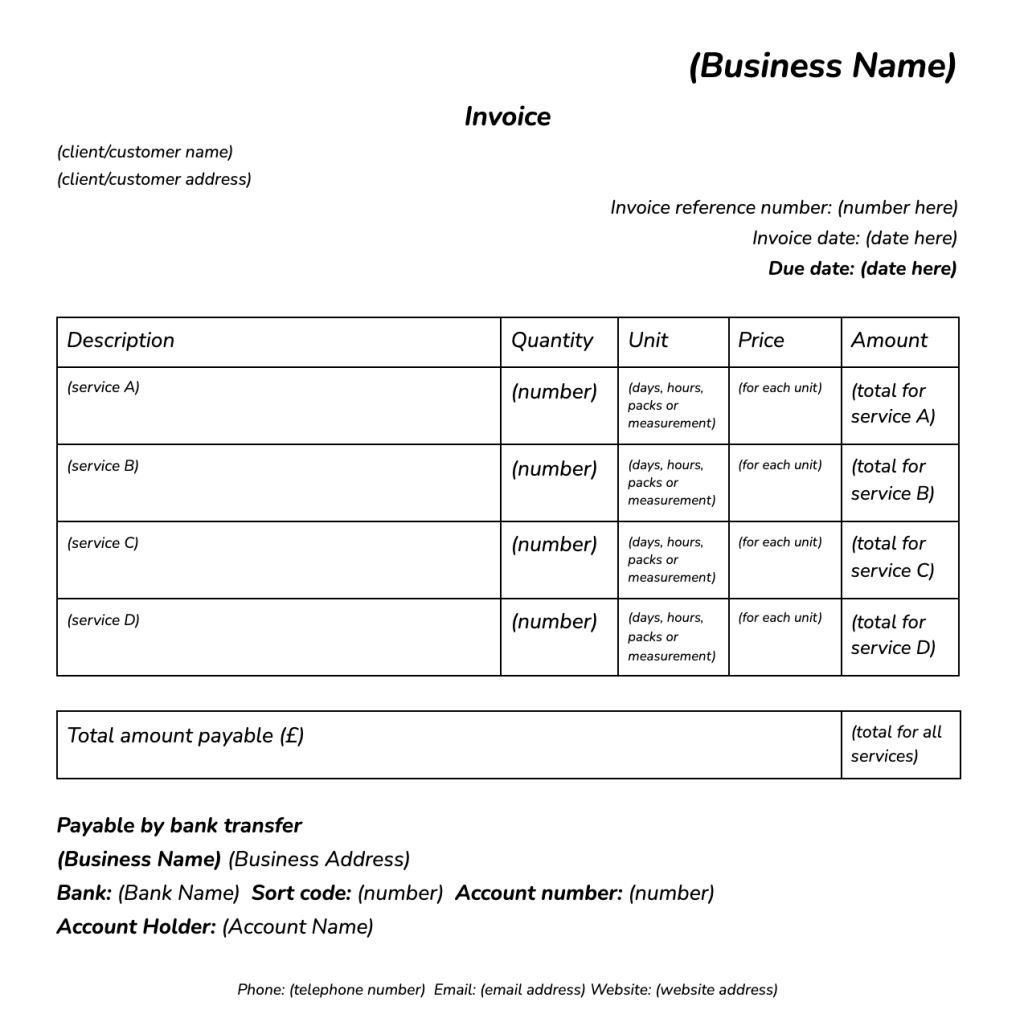

To give you some help to create your own, here is a self-employed cleaner invoice template. Copy and paste the template into your own document and change the bracketed information, input your cleaning service details to start sending the invoices out. There are also a few key things you need to include in your invoice.

First, label the document as an invoice to clarify the document type. You’ll also need to provide an invoice number for each document, which will allow you to add it to your records (e.g. invoice 001).

To make the invoice official, you should put the information about your business. For example, if your cleaning service has a name, then use that. If not, use your own name. Also, put the address of your business. If your business is a limited company, you must include your registration number. If your business is VAT registered, have that number too. You can also put the client’s details, name and address.

It is essential to include an itemised list for each service you provide. Being specific will help the client see each thing going towards the final fee. You may also charge labour costs, so include that in the list along with the time it took and the price you charge for the labour.

Make sure the invoice also includes a payment due date. Without one, you may not be able to argue against late payments. When putting together the invoice, also include a date on which you record the invoice.

To make it easier for the clients to pay you, provide your payment details. After adding your list of services, you should know how much to charge in your invoice. Suppose you prefer to receive the payment in cash or by bank transfer. In that case, mention that but put the relevant information for the method.

How can Countingup make invoicing easier for me?

When you are a self-employed cleaner, it can be difficult to keep writing out and recording invoices. As your business grows, you want to be able to make the best use of your time, so to make invoicing easier, you can use Countingup. With the app, there is no need to manually input into a self-employed cleaner invoice template.

With the Countingup app, you can:

- Create an unlimited number of customised invoices (free)

- Add your logo to invoice templates

- Send invoices to customers

- Receive a notification when a client pays an invoice

- Match a payment to an invoice

- Duplicate an invoice

- Change invoice’s due date

Invoicing will always be a huge part of your business, but it doesn’t need to take up so much of your life. With the ability to make your invoices more professional, easier to send out and easier to manage, Countingup can give you the time to focus on other things. The platform is built to make invoicing as easy as possible for you.

Invoicing is just the beginning, there’s so much Countingup can do for you

Financial management can be stressful and time-consuming when you’re a self-employed cleaner. That’s why thousands of business owners use the Countingup app to make their financial admin easier.

Countingup is the business current account with built-in accounting software that allows you to confidently keep on top of your business finances wherever you are.

Start your three-month free trial today.

Find out more here.