10 ways to improve cash flow management

Table of Contents

To keep your business in good financial health and ride out the turbulence of current global uncertainty, staying on top of your cash flow management is key. Apply these 10 techniques to get started:

1. Be selective

Turning down new business is not easy and needs steely resolve, but doing your research and turning down clients who are less likely to pay you on time will save you from major headaches and cash flow problems. We recommend conducting a credit check on potential clients if you can. There are many warning signs when it comes to bad clients. In the excitement that comes with landing a new project, especially a lucrative one, it’s easy to ignore these signs. However, if something feels off from your initial interactions, trust your gut. Ending the conversation sooner rather than later will likely be in your best interests.

2. Set out your terms and conditions

If your client’s credit check indicates they are reliable, your next step is to set out the terms and conditions under which you will be paid. Outlining expectations at the start of a working relationship will make things easier down the line – and it’s important that this is in writing. Watertight terms and conditions will establish your rights and responsibilities and can save you a lot of time and money in the long term.

A standard set of terms and conditions may be all you need to cover key points – from payment and delivery terms to what happens if you aren’t paid. However, depending on the nature of your service, contracting a solicitor to draw up a bespoke document may be a worthy investment.

3. Build a good rapport

Once you’ve entered a contract, creating and maintaining a good relationship with your client is key. It’s harder to delay a payment to someone you’re on good terms with.

4. Track your invoices

Increase your chances of prompt payment by invoicing your clients soon after delivering your service. With an app like Countingup, you can create and send instant professional invoices to your clients on the go, and receive notifications when you’ve been paid.

If your invoice’s due date has passed, set up reminders to follow up with your client at regular intervals. Don’t be afraid to pick up the phone if you’re still waiting for payment a couple of weeks later.

5. Plan for the future

As challenging as it can be for a business owner to prepare cash flow projections, it’s one of the most important things you can do to be on top of your cash flow management. Estimating how much money you expect your business to receive and pay out over the next year can help you plan ahead and alert you towards challenges before they arrive.

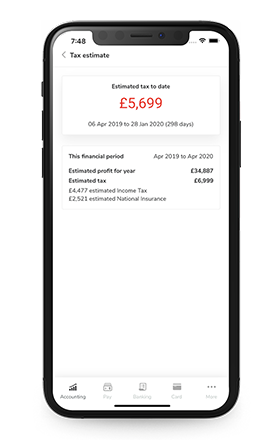

Preparing cash flow projections will also involve consolidating your detailed knowledge of amounts and dates of future cash outlays. Create a line item on your projection for each significant outgoing cost, including inventory and equipment (when purchased with cash), taxes and more. The Countingup app gives live tax estimates all year round, which means you can always have a clear insight into how much cash you need to set aside.

6. Cut your costs

Overheads can easily drain your cash position. Work through your expenses line by line and get brutal with your costs. Can you find a better deal for current outgoings? Are there subscriptions that haven’t proved their worth? Define what’s necessary and elements that are no longer adding value. This will help you limit spend and be firmer when allocating budgets.

Review your supply base regularly and establish good relationships with any suppliers to negotiate better rates.

7. Save money by automating financial admin

One of the easiest ways to improve cash flow management is to use a tool that will make your financial admin simple. The all-in-one app and business account Countingup will give you real-time insights into your cash flow, automate your accounting and estimate your taxes so that you know how much to set aside. Countingup is the UK’s most highly rated business account on Trustpilot and used by over 50,000 small businesses, sole traders and self employed people to save time and money on bookkeeping costs.

8. Create a financial safety net

A rainy day fund can be a lifesaver for a business. Many experts recommend setting aside six months worth of expenses as an emergency fund. If this target feels impossible, aim to save for three months of expenses to begin with. Make sure to create a time frame for your goal and be consistent about setting aside funds. Once you’ve achieved your target, you’ll have formed some good saving habits.

It’s important to note that a six month reserve won’t be the best solution for every business. By nature, emergency funds tie up cash that could be used to expand the business, so could limit profit and growth. Your accountant will be able to advise on the cash reserve that is optimal for your needs.

9. Use an accountant

Partnering with an accountant with relevant experience for your business size and/or industry can be more cost-effective than not. To keep you compliant and save you from penalties, your accountant will inform you of any changes regarding tax legislation. They can also offer long term financial strategies to help you grow your business.

10. Consider new revenue streams

Creating new revenue streams by expanding your client base or offering additional services to your current clients is another way to increase your revenue and so cash flow too.

When you commit to incorporating each of these techniques, effective cash flow management will soon become an automatic part of how you run your business and you can sleep better knowing that your business has more resilience to withstand any uncertainty that lies ahead.