How to set up a home office for tax purposes

Table of Contents

Many small businesses are based from home, and when running your own company, every penny counts. Knowing how to manage your expenses is a big part of being tax-efficient and is valuable knowledge to have when running your own company. Using a home office for running your business can benefit you when it comes to your tax return, and this article will explain how.

Keep reading to find out how to set up a home office for tax purposes, and we’ll dive into the following areas:

- How to set up a home office

- What you can claim back on your tax return

- How simplified expenses work for a home office

How to set up a home office

If you’re looking to work from home for the tax benefits, you must be using a room as an office for most of your work. For example, if you use an office space for a small amount of administrative work, but your main business activities are carried out elsewhere (such as client premises or at worksites), then this won’t be acceptable to HMRC.

If you mainly operate from one space, you can claim back the cost of putting together a home office on your expenses.

To set up an office, first, choose your space. For example, do you have a separate room that you can use? Or will you need to use a communal space such as a dining table or a room with another purpose like a spare bedroom?

The purpose of the room matters in the eyes of HMRC. For example, if you are using a dining room to work from, you will not be able to claim certain items back (like a chair or the table itself) because they have other purposes that are not solely for the business.

Then furnish your space. If a room is solely used as a business office, you will be able to claim back the purchases you make for it, whether it’s a chair, the desk, a bookshelf or your office supplies such as paper, pens or ink for a printer.

Purchases of equipment or tools that are necessary for you to perform your duties are perfectly acceptable expenses.

What you can claim back on your tax return

As mentioned, all office supplies and equipment and technology such as laptops or computers you need for your work are allowable expenses in the eyes of HMRC. But the way you will claim them back will differ slightly depending on if you are a sole trader or a limited company.

Sole traders will claim the costs of their office items back on their self-assessment. Limited companies will record the items for the office as fixed assets and be able to claim back on their corporation tax.

An area of confusion is internet and phone costs. If you use your home Wifi or your personal mobile phone for business use, you will not be able to claim back a percentage of that bill.

Business expenses must be ‘wholly and exclusively for the company, so if your bill has ‘dual purpose’ — both for business and personal use — then it will be difficult to prove the percentage of the bill you want to claim back to HMRC. You can certainly send the claim in if you use your phone or internet 50% of the time, but it will be unlikely to be accepted without proof.

In this instance, it would be better to take out a separate phone and internet contract in the business name so that you could claim this back. Again, proving the cost will be easier as the paperwork will reference the business name.

How simplified expenses work for a home office

You can use the simplified expenses for working from home, which can work out to £312 per year. If you’d like to claim back more than this based on the actual total of your rent or mortgage, utilities, and council tax, then you can.

If you’re a sole trader, you’d have to calculate the exact percentage of time you spend in the home office and divide your bills by this percentage.

It’s more complex if you are a limited company. To claim back more than £312 could involve creating a rental agreement where you rent your house space to your business. You should seek specialist advice on this, as you may have to navigate Capital Gains Tax if you sold the property, and you should be wary of the ‘rent’ being charged as extra income.

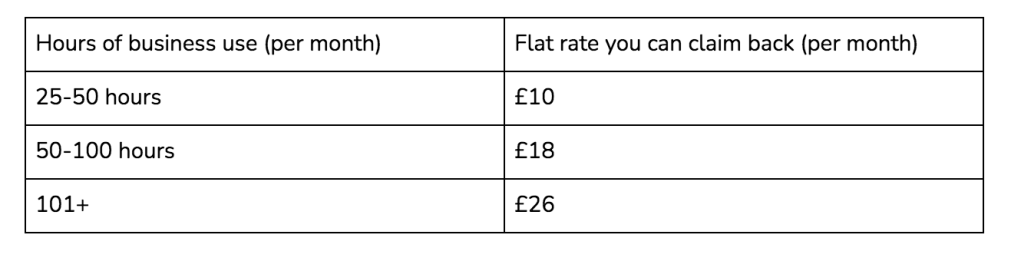

If you work more than 25 hours per month from home, you can claim back expenses using a simplified method. You can use the gov.UK checker to see if you can save money using simplified expenses instead.

Simplified expenses are where you can claim back a flat rate, per month, for using an office out of your home. Since your utilities such as water and heating might go up as you’re spending more time in the house, simplified expenses aim to make up for this by allowing the costs to be tax-deductible.

Telephone and internet costs are not included in the flat rate, so you can claim these separately. But remember, the cost must be ‘wholly and exclusively for the business so it may be worth purchasing separate contracts from your personal phone and internet.

Without separate lines for the business, it could be challenging to prove the percentage of your phone and Wi-Fi bills you use for business purposes.

Make your financial management simple with Countingup

Financial management can be stressful and time-consuming when you’re self-employed — that’s why thousands of business owners use the Countingup app to make their financial admin easier.

Countingup is the business current account with built-in accounting software that allows you to manage all your financial data in one place. With features like automatic expense categorisation, invoicing on the go, receipt capture tools, tax estimates, and cash flow insights, you can confidently keep on top of your business finances wherever you are.

Countingup can manage your expenses and categorise them for you, which in the end will give you a tax estimate. This could save you hours of bookkeeping admin and you’ll always know how much you owe HMRC with this feature.

Find out more here.