How to calculate tax withholdings for an independent contractor

Table of Contents

One of the main challenges for independent contractors is figuring out how the tax system works. If you are a freelancer falling outside of the IR35 remit, you are responsible for calculating and declaring the taxes owed on your income.

However, if you are considered an effective employee per IR35, your client is responsible for deducting taxes from your payslip.

Here we’ll explain how to calculate tax withholdings for independent contractors by answering the following:

- What taxes do independent contractors pay?

- How does VAT work for contractors?

- When does IR35 affect contractors?

- How do I pay tax as an independent contractor?

- Why will Countingup help manage my taxes?

What taxes do independent contractors pay?

Part of understanding how to calculate tax withholdings for an independent contractor is knowing what taxes apply to you.

Self-employed contractors will pay National Insurance contributions through tax withholdings or as part of their self-assessment tax return.

Income tax against earnings is deducted at source for IR35 employees or paid directly to HMRC.

If you are a contractor trading as a limited company, you’ll also be liable for Corporation Tax nine months after the end of your financial year and VAT if your turnover is £85,000 or more per annum.

How to calculate tax withholdings for independent contractors?

Tax withholdings are the proportion of your income deducted from your pay and remitted directly to the government – for employees that refers to the PAYE deductions of income tax, National Insurance and student loan repayments.

If you’re an independent contractor, you typically won’t pay withholding tax because you’ll submit self-employed tax returns, or business accounts, with income from clients received as a gross value.

However, contractors enrolled in the Construction Industry Scheme (CIS) and IR35 contractors treated as employees for taxation purposes may have income taxes deducted at a standard rate.

The best way to calculate these withholding taxes is to retain records of every payslip and total the deductions to include on your tax return.

How does VAT work for contractors?

Contractors may be subject to VAT if they exceed the £85,000 annual threshold or opt to register voluntarily.

Accounting for VAT means that you need to know which goods or services you supply are subject to VAT and which rate applies – standard, reduced, zero or exempt VAT rates.

The basics of VAT is that the sales tax is split into two elements.

- Contractor invoices (output tax): Any invoices you issue must include an additional VAT charge of 20% for standard-rated services in 2021/22. The total VAT collected is payable to HMRC on your next VAT return.

- Contractor purchases (input tax): Purchases made and expenses incurred may also include VAT. You claim back your input taxes, balanced against the output tax owing.

At the end of every quarter, contractors need to add up all transactions and pay or claim a rebate from HMRC for the difference.

When does IR35 affect independent contractors?

Contractors inside IR35 pay the same income tax and National Insurance Contributions as employees. However, contractors do not receive employment benefits like paid holidays, sick leave or a company pension.

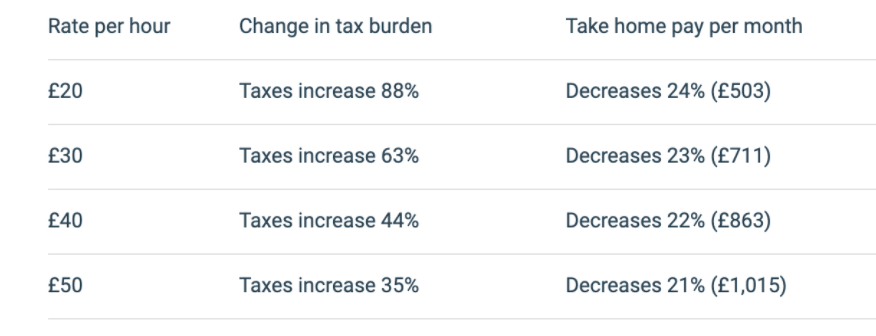

As a result, the difference in contractor take home pay inside and outside IR35 is quite significant.

If you’re assessed as inside IR35, it could reduce your net income by 24% per month (as illustrated below).

Additionally, HMRC can re-evaluate contracts up to six years ago in your trading history.

If IR35 applies to any of your previous contracts, you may be exposed to significant charges for backdated taxes.

Inside IR35

If you’re an independent contractor inside IR35, it means your client treats you as an employee for tax purposes. Your client or employer is responsible for deducting income tax and National Insurance through the company’s PAYE (Pay As You Earn) system.

Contractors inside IR35 must pay the following:

- Employees’ National Insurance of 12% on all income above £184 per week, up to £967.

- Income tax of between 20% and 45%, excluding their personal allowance, depending on their earnings bracket.

We explain how National Insurance works in much more detail in this guide.

Outside IR35

If you can demonstrate that your contracting business operates outside IR35 (meaning your business is fundamentally separate from your client’s), you manage your taxes.

This situation means you deduct your expenses from income to arrive at a profit or income figure and charge VAT if your turnover is above £85,000.

Operating outside IR35 means that you can pay yourself a salary, take dividends, claim all costs and manage your taxes as usual if you are registered as a company, or retain your net profit as a self-employed trader.

If the former, you will pay reduced taxes but are liable to declare and pay Corporation Tax of 19% on your net taxable profit at the end of each financial year.

How do I pay tax as an independent contractor?

The correct process depends on whether your contracting firm is an incorporated business or a self-employed sole-proprietorship.

Self-employed contractors first need to register for Self Assessment. You can either do this yourself or hire an accountant to do it for you and receive a Unique Taxpayer Reference (UTR).

Each year, you will file submissions showing your earnings and expenses and need to pay the subsequent tax liability, plus National Insurance contributions based on your operating income.

Learn about completing a Self Assessment tax return and the mistakes to avoid when doing your tax returns here.

How can Countingup help manage my taxes?

Setting up a Countingup accountancy app and combined business current account gives you the functionality to keep firm control over all of your financial information.

The accounting software automates most of your bookkeeping, so you can quickly check your estimated tax bill and collate the information required for each submission.

Countingup is engineered to make life easier for small businesses and contractors, and therefore simplifies the process, whether you need to calculate your annual tax withholdings or prepare year-end accounts.

Download the app here.