How to calculate return on investment (ROI)

Table of Contents

The definition of an investment is any spending you make with the expectation of a positive benefit. For most investments, this is the hope that your investment will make you more money than you originally invested.

This article will guide you through the process of working out just how much your investments will make. We’ll look at the definition of a return on investment and the methods of calculating it. The topics covered in this article include:

- Return on investment definition

- How to calculate return on investment

- Why calculating return on investment is important

- How Countingup can help you calculate return on investment

Return on investment definition

Return on investment, also known as ROI, is a kind of mathematical formula that allows investors and business owners to work out how much money they’ll earn from an investment.

‘Investment’ has a fairly vague definition, so the word can be most kinds of business expenses. For instance, buying new computers or equipment is an investment, as is buying property or even paying for training courses.

You can use the ROI calculation to determine how worthwhile a particular investment was. If you know exactly how much money you’ll make from a specific investment, you can even calculate your ROI before spending any money.

Some people use the term ‘return on investment’ in a qualitative way, which means they’re using it to refer to benefits gained from an investment that you can’t calculate or display via numbers. For example, this might be a training course that’s made you more confident during sales pitches, or new furniture that’s made your office far more comfortable.

It’s likely that the qualitative returns on investment also end up increasing your profits, but it’s difficult to describe this connection in a precise way. This article will specifically focus on the numerical kind of ROI, and how you can calculate it.

How to calculate return on investment

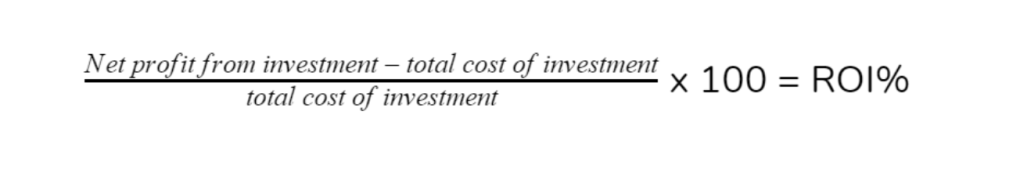

To calculate ROI, you need to subtract the cost of your investment from your total profit, divide that by the total cost of the investment, and then multiply the result by 100 to get a percentage. In accounting, it’s written like this:

Remember to only use the net profits in your calculation to ensure it is accurate. Net profit is the money left over after you subtract the initial cost of the investment and any other expenses.

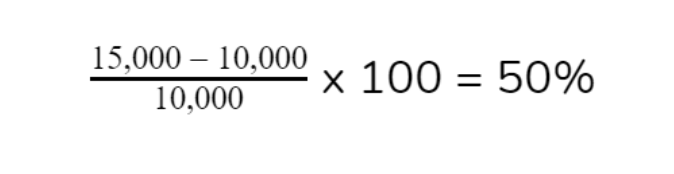

Here’s an example of the calculation, so you can see it in use. Say you spend £10,000 on new equipment, and your gross profit (the money you make before you subtract any expenses) is £15,000. First, you’ll subtract the 10,000 from the 15,000 to get the net profit — £5,000. Then you’ll divide that by 10,000. Here it is in the ROI formula:

As you’ve spent £10,000 and made £15,000, that’s a 50% ROI — you made your money back plus 50%. In the business world, a 50% ROI is usually very good, but the definition of a good ROI is unique to the needs of your business and the amount of money involved. Stock market investors suggest that a 7% ROI is a good starting point.

You might get a negative number when you subtract the cost of the investment from the gross profit. This would mean that you’ve lost money on the investment.

Remember to take care when you work out the total cost of your investment. In the example we provided, you spent a total of £10,000 on new equipment. That total takes into account both the actual price of the equipment plus the cost of installing it, maintaining it, and getting rid of the old equipment.

Why calculating your return on investment is important

Knowing your return on investment can be very useful for financial planning as it allows you to judge the success of your previous investments. This is vital in a business, as the success of previous investments can significantly influence your spending in future. For instance, if you have a very high ROI from an investment in marketing and advertising, you’ll know that it’s a good idea to invest in marketing if you’re looking to make more money.

Being able to calculate ROI is also essential if you’re trying to find investors for your business. If you can calculate the ROI from previous investments in your business, you can show this to other investors to encourage them to give money to your business.

Finally, calculating ROI is excellent as a way to set goals for your business. For example, say you’re going to start hiring staff, but you’re worried the cost of your first employee will negate any potential profits. You can use ROI to calculate sales goals for that employee, i.e. you can work out how much they’ll need to make in sales revenue to be a profitable part of your business.

How an app can help you calculate return on investment

To calculate your return on investment, you’ll need to have access to your company’s financial data. This is much easier if it’s all stored in one place, so you should consider using a financial management app like Countingup to keep track of your company money.

Countingup is the business current account with built-in accounting software that allows you to manage all your financial data in one place. With features like automatic expense categorisation, invoicing on the go, receipt capture tools, tax estimates, and cash flow insights, you can confidently keep on top of your business finances wherever you are.

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies. Seamless, simple, and straightforward!

Find out more here.