How much National Insurance do I pay? Ultimate NIC guide for the self-employed

Table of Contents

When you’re self-employed you need to wear many different hats to run your business effectively. The accounting side is probably the most confusing and frustratingly time-consuming. On average, small business owners spend more than 40 hours each year preparing their tax returns.

Additionally, the UK’s tax system is far from straightforward. So, if you’re finding it tricky to navigate, you are not alone. This guide will help you understand one part of the UK tax system that confuses many business owners: National Insurance Contributions (or NIC).

In this ultimate guide for small business owners, we’ll answer:

- What is National Insurance?

- Why do I need to pay National Insurance?

- What is my National Insurance number?

- How much National Insurance do I pay?

- How do self-employed people pay National Insurance?

- What is a Self Assessment tax return?

- How do I complete a Self Assessment tax return?

- What are the deadlines for Self Assessment filing?

- What are the self-employed National Insurance tax brackets?

- What is the Class 3 voluntary contribution?

- What does National Insurance pay for?

What is National Insurance?

National Insurance is a tax you pay on earnings and self-employed profits, which you pay into a fund that the government uses to pay state benefits. These benefits include state pension, statutory sick pay, maternity leave and additional unemployment benefits.

Employers, employees and self-employed workers pay National Insurance until they reach the state pension age (calculate your state pension age here), after which they no longer pay NIC.

Why do I need to pay National Insurance?

As mentioned above, paying National Insurance Contributions gets you certain benefits. However, the benefits you’re entitled to vary depending on what NIC Class you fall into. We’ll cover this in more detail in a later section.

It’s worth noting that you need to pay into National Insurance for a specific number of years to be entitled to receive a state pension (explained later). Additionally, you may not qualify for some other benefits, like Maternity Allowance or additional unemployment benefits. Find out more about statutory maternity pay for the self-employed in our dedicated guide.

What is my National Insurance number?

Every UK taxpayer has a National Insurance Number (NIN) set by the Department of Work and Pensions. The NI number is unique to you so the government can track your allowances, how much tax you have paid and check how much state pension you might be owed.

Each person gets one NI number that they use throughout their entire life. If you’re a UK citizen, you typically get assigned a number when you turn 16. If you move to the UK to work, you’ll need to apply for a National Insurance number.

National Insurance numbers contain two letters, six numbers and a final letter.

How much National Insurance do I pay?

The rules for how much you pay are a little different depending on if you’re an employee or self-employed.

If you’re employed

If you’re employed by a company, you pay Class 1 National Insurance Contributions). The rates for most people for the 2021 to 2022 tax year are as follows:

- If your pay is £184 to £967 a week (£797 to £4,189 a month), you pay 12% with the Class 1 NIC rate.

- Over £967 a week (£4,189 a month) = 2%

However, as an employee, you would pay less NIC if:

- You’re deferring National Insurance because you’ve got more than one job. Note that this only counts if you’re employed at two different companies, not if you run a company as a side business.

- You’re a married woman or widow with a valid ‘certificate of election’. government guidance states that “Until 1977, married women could choose to pay less National Insurance. If an employee opted in before the scheme ended, she can keep paying a reduced rate”. Find out more here.

If you’re an employer, you pay a different rate of National Insurance depending on your employees’ category letters. Visit the government website for more information about National Insurance rates letters and how much you pay in different categories.

How do self-employed people pay National Insurance?

The rules are a little different for self-employed people who mainly pay National Insurance through their annual Self Assessment tax return. As a self-employed person, you pay Class 2 NIC if your profits go over £6,515 in a year. If your profits go over £9,569, you pay Class 4 NIC (more details on rates and thresholds below).

Keep in mind that:

- You won’t pay NICs if you’re under 16 or over the state retirement age

- You don’t have to pay Class 2 NICs if you’re a married woman who opted into the Reduced Rate scheme before it ended in April 1977

- Separate rules apply to share fishers and voluntary development workers

Even if you’re self-employed and don’t pay NIC through Self Assessment, you may choose to make voluntary contributions. This could apply if you fall within one of the following job categories:

- Examiner, moderator or invigilator

- Religious minister, providing that you receive no salary or stipend

- If you make investments without receiving a commission or fee, and not as a business

- If your business involves land or property

What is a Self Assessment tax return?

Your Self Assessment tax return is how you report your untaxed income to HMRC. It takes into account all your income, outgoings and profits for the last year.

HMRC uses your tax return to calculate how much income tax you need to pay, based on the profits you’ve made. Employees don’t need to complete a Self Assessment as their tax is automatically deducted from their salary before it hits their bank account through the PAYE (Pay As You Earn) system.

If you’re self-employed, you’ll need to report your income to HMRC by setting up an online account on their website to complete and submit your Self Assessment form.

How do I complete a Self Assessment tax return?

You can complete and file your Self Assessment tax return online via the HMRC website. Remember, you’ll need to keep specific financial records to complete the form.

If you’re a sole trader, you’ll need to keep records of:

- Your expenses

- Invoices you’ve sent out

- Other business income, e.g. selling off assets like equipment or property

If you’re a limited company director, you’ll need additional pieces of information, including:

- Your P60 (shows tax you paid in the past tax year)

- Your P11D (only applicable if you have employees who get ‘benefits in kind’ from you, such as a company car)

You can find out more about different tax forms on the government website.

What are the deadlines for Self Assessment filing?

For the 2020/2021 year:

- The deadline for registration is 5 October

- The deadline for the paper tax return is 31 October

- The deadline for the online tax return is 31 January 2022.

The end of January is also the deadline for actually paying the first instalment of your tax bill, while the second instalment will be due on 31 July 2022.

What happens if I miss a deadline?

HMRC can fine you for missing the tax return deadline: £100 for three months’ delay and even more if you wait longer. To avoid owing unnecessary money, make sure you file on time.

It usually takes between five days and eight weeks for HMRC to process a Self Assessment. This can depend on whether you applied online or by paper and whether HMRC does any security checks during the process.

Staying on top of your income and expenses throughout the year makes the Self Assessment process much more manageable. Remember to keep a record of your costs and don’t lose your receipts! The Countingup app has a handy receipt capturing tool so that you can save receipts on the go.

For more detailed information on completing your Self Assessment, download our Comprehensive Guide: How to complete your Self Assessment in 3 simple steps.

What are the self-employed National Insurance tax brackets?

Class 2 and Class 4 are charged at different rates, as listed below:

The Class 2 National Insurance Contribution is £3.05 a week, which you only get charged if your annual profits are £6,515 or more.

You only get charged Class 4 National Insurance Contributions if your profits are above £9,569 a year. The rate is 9% of profits between £9,570 and £50,000 and 2% on profits over £50,000.

Class 2 NIC rates 2021/22

- Small profits threshold = £6,515

- Weekly rate = £3.05

Class 4 NIC rates 2021/22

- Self-employed start paying above = £9,568

- Pay a lower rate above = £50,270

- Initial rate = 9%

- Rate above £50,000 = 2%

What is the Class 3 voluntary contribution?

If you’re self-employed and not paying NIC, you may choose to make voluntary contributions (Class 3 NIC) to fill any gaps in your NI records and get a higher state pension. Or, you might make voluntary contributions if you had small profits during periods of running your own business.

You can use the gov.uk tool to check if you have any gaps in your records you need to address and whether you’re eligible to make voluntary contributions.

The state pension is payable to people who were born before 6 April 1951 (men) or 1953 (women). You’ll need to have 35 qualifying years of National Insurance Contributions to receive the full pension.

Any person with fewer qualifying years will receive a reduced state pension, for which you need a minimum of ten years of NI contributions. If this is the case, you may want to consider paying Class 3 contributions to boost your pension entitlement.

For 2021-22, you can pay Class 3 contributions at a weekly flat rate of £15.40.

What does National Insurance pay for?

Your National Insurance payments go towards state benefits and services, including:

- The NHS

- The State Pension

- Unemployment benefits

- Sickness and disability allowances.

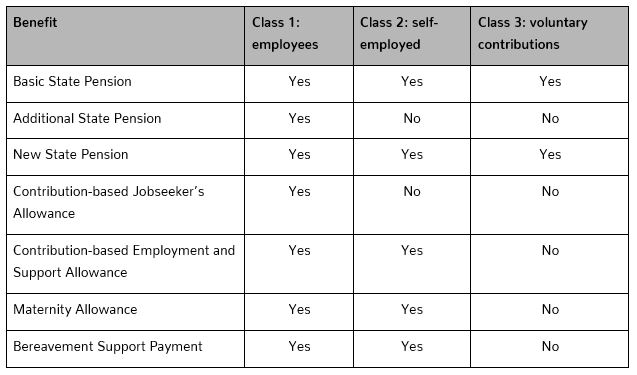

Class 4 contributions paid by self-employed people with a profit of £9,569 or more do not usually count towards state benefits. The other Classes contribute as listed in the table below:

Now that you understand more about National Insurance, we hope we’ve given you some added confidence when it comes to your financial management. If you want to make the accounting side of your business more simple and effective, Countingup may have just the solution for you!

Be ready to calculate your National Insurance with Countingup

Countingup is the business current account and accounting software in one app. It automates time consuming bookkeeping tasks so that you can focus on running your business. With instant invoicing, automatic expense categorisation and cash flow insights, you can confidently keep on top of your business finances everyday. Find out more here.

All this will help you be prepared when tax season comes around and you need to work out your National Insurance Contributions.

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies. Seamless, simple, and straightforward! Find out more here.