How does IR35 affect contractors?

Table of Contents

IR35 is a new tax law that aims to prevent individual contractors, or self-employed freelancers, from paying less tax than they should. The legislation looks at ‘disguised’ employees – who file returns as contractors but are, in effect, employees and should be enrolled in PAYE.

HMRC research suggests that this change could generate an additional £1.3 billion in taxation income.

Today we’ll answer the following questions:

- What is IR35?

- How does IR35 affect contractors?

- Am I inside or outside of the IR35 criteria?

- How can I avoid being caught up in IR35?

- How can Countingup help with IR35 compliance?

What is IR35?

The IR35 rules came into force in April 2021 and look to better define the difference between an employee (someone employed by a business) and a contractor (a self-employed individual).

Before IR35, contractors themselves determined their employment status, but a key change is that the responsibility now falls to the company – which has been the case in the public sector for quite some time.

Hiring contractors, even if they are treated the same way as an employee, is cost-effective for businesses. The company doesn’t need to pay employee benefits, such as sick or holiday pay, and can dismiss a contractor without notice.

Employers forgo National Insurance contributions, auto-enrolment pension scheme rules, and other costs rolled up into regular employment.

Under IR35, medium and large companies must determine whether each contractor works for them regularly enough to be classed as an employee.

How does IR35 affect contractors?

Contractors inside IR35 are in ‘deemed employment’ and must pay the same income tax and National Insurance contributions as employees. However, they will not receive employment benefits, such as paid holiday, sick leave or pension.

The business isn’t obliged to offer an employment contract, but it must make the requisite tax provisions and remit a deemed payment to HMRC at the end of the tax year.

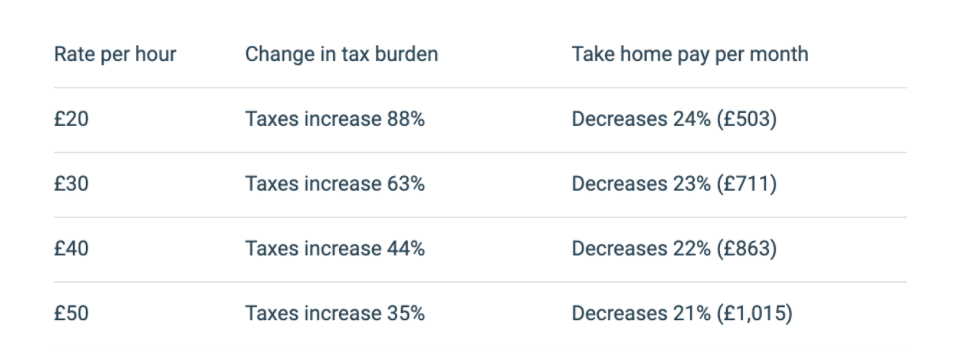

The difference in take-home pay for a contractor inside and outside of IR35 is significant. Therefore, if you’re assessed as inside IR35, it could impact your finances, reducing net income by up to 24% per month:

To compound matters, HMRC reserves the right to evaluate contracts over the last six years and could potentially raise a tax levy of hundreds or even thousands of pounds regarding backdated tax.

It’s therefore unsurprising that a proportion of contractors and businesses are unhappy about IR35.

Am I inside or outside of the IR35 criteria?

IR35 applies to any contractors, freelancers or self-employed workers who are treated as employees.

Contractors remain responsible for determining their status if they work for a small business, and the criteria to fall outside of IR35 include:

- The ability to control how much work they do, hours, and place of work.

- How integral the contractor is to the business operations.

- Any financial risk of the contractor, such as purchasing equipment.

- Whether there is a contract or commitment in place.

- The volume of working hours spent on tasks from the business, and whether there are limitations on other jobs they can take on.

- Having the option of sending a substitute to complete a task and whether the company is entitled to reject a substitute.

For example, if you work full-time for one business, have to be in an office for set hours, cannot accept other work, and have a commitment in place, you are an employee paid as a contractor.

If, however, you have several clients, pick and choose when you work on each task and have the option of turning down projects when you’re fully booked, you are a legitimate contractor.

How can I avoid being caught up in IR35?

Many contractors fear that IR35 will cause financial disaster. Still, it’s essential to be cautious about checking whether you fall inside the IR35 remit and adjust your working practices accordingly if you don’t wish to.

HMRC may request evidence that your work is genuinely freelance, so it’s well worth getting your paperwork correct to back up your contractor status.

1. Retain client correspondence

Independent contractors are not bound by employment agreements, setting out working conditions such as minimum hours, holiday entitlement and pension arrangements.

As an independent contractor, these conditions don’t apply, which you should be able to prove by showing HMRC your client communications. Make sure to get the terms of your contract in writing to support your contractor status.

2. Don’t name the business after yourself

HMRC recognises that a company named after an individual may well be a Personal Service Company (PSC), meaning that one self-employed person offers services to clients.

However, giving your company a name such as XYZ Plumbing shows that your enterprise is a separate entity to you. This way, you emphasise the option to delegate your work, which would help clarify your status outside of IR35.

3. Keep your business separate

Having a private place of work for your self-employed contractor business (even if a desk in your home) demonstrates that your work extends beyond your current client. Purchasing your own software licenses, training, and holding trade memberships also helps separate your business.

Additionally, having business insurance, such as professional indemnity insurance, is an excellent way to demonstrate that you’re not an employee.

4. Take on multiple clients

While it’s not always possible, it’s fairly unlikely HMRC will consider you a deemed employee if you split your time evenly between multiple clients.

If you earn 90% or more of your income from one business, it’s a less obvious situation.

How can Countingup help with IR35 compliance?

A Countingup business current account allows you to manage all of your financial data in one place. The free app incorporates built-in accounting software, which automates the most time-consuming bookkeeping tasks.

You can view real-time insights into your finances, see tax estimates and invoices, and share bookkeeping with your accountant without worrying about duplication errors, data lags or inaccuracies.

Countingup functionality makes it significantly easier to demonstrate your tax position to HMRC, with clear income logs, client reports and revenue figures to evidence your contractor status.

Download the Countingup app today, and apply for your business current account in minutes with just a selfie and proof of ID! Download the app here.