Balance sheet explained: 5 steps for preparing a balance sheet for beginners

Table of Contents

The balance sheet is one of the most common financial reports you’ll have to prepare when running your own business. In this article, we’ve broken down how to prepare one into five steps, to make the process as quick and easy as possible for you. Keep reading to find out what a balance sheet is and how to get yours ready.

- What is a balance sheet?

- Step 1) Prepare a spreadsheet or table

- Step 2) Total up your business’ assets

- Step 3) Add up your business’ liabilities

- Step 4) Calculate your owner’s equity

- Step 5) Put the information into your sheet

The balance sheet explained

A common report for small businesses that checks their financial health is a balance sheet. Simply put, the balance sheet is a two-sided chart that on one side shows the value of what you owe, and on the other, what you own.

As the name of the balance sheet suggests, the total of each side should come to the same amount to show if your business is financially stable or not.

Step 1) Prepare a spreadsheet or table

Start by choosing how you will display your balance sheet. You can use a simple table or a basic spreadsheet, such as Excel or GSheet, or any other open-source software you choose to use.

Your sheet will need to spread across four columns, to list the items on each side and their values. Scroll to the bottom of the article to see a basic table laid out as a balance sheet.

Now we’ll cover what will be in the horizontal rows of your table or spreadsheet.

Step 2) Total up your business’ assets

First, you need to total up the value of the assets your business holds. Assets are items or resources that have financial value.

Assets are usually separated into two groups, based on how quickly that asset can be turned into cash.

Current assets can be quickly converted into money. These are items that are fairly simple to sell and value, such as:

- Stock and inventory

- Cash in the bank

- Money owed to you (through unpaid invoices)

- Customer deposits

- Office furniture, equipment or supplies

- Phones or laptops

- Relatively trivial items like a fancy coffee machine or pool table

Fixed assets are valuable resources that take a longer time to sell, hence it would take longer to get the cash in the bank, such as:

- Property or buildings

- Machinery

- Specialised equipment for your business operations

- Investments, such as stocks or bonds, that may take a while to cash out

- Vehicles

In your spreadsheet, list the current assets with their value in the next column. Then, underneath, list your fixed assets and their values. You’ll then add up the total value of all your assets.

Beginner tip: in Excel, highlight the cells with the asset values, and in the bottom left corner it will show you the added up total without you having to create the formula. This minimises the risk of any human error messing up your figures.

Step 3) Add up your business’ liabilities

The next step is to list your business’ liabilities. These are the funds that you owe to other people, banks or businesses and can cover a variety of debts, such as:

- A business loan (the total, not the monthly payment amount)

- A mortgage or rent payment on a property

- Supplier contracts you owe

- Your accounts payable total

- Other financial obligations, such as paying wages or freelancers for support

- Taxes due to be paid to HMRC

List these in the same way you did with your assets, on a spreadsheet with their values in a separate column.

Step 4) Calculate your owner’s equity

Owner’s equity is how much of the assets you own as the owner of the business. If you are a sole trader or the only owner of the company with no shareholders, then this will be a simple calculation.

Basically, your owner’s equity shows how much you would be left with if all assets were sold and all debts were paid. You can work it out with a simple subtraction sum, with the following formula:

Assets total – Liabilities total = Owner’s equity

Then put this final figure for your owner’s equity into the sheet underneath your liabilities.

Step 5) Put the information into your sheet

If you’ve followed the steps, you’ll have your assets on one side of a table and your liabilities and equity on the other. As the name suggests, the totals should balance and fit this formula:

Assets total = Liabilities total + Owner’s equity

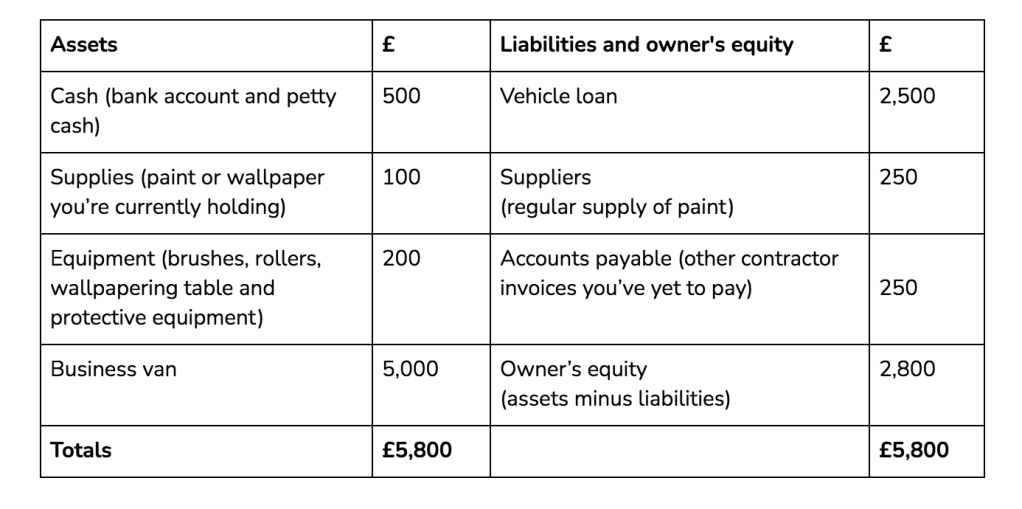

Using a self-employed painter and decorator as an example, the balance sheet could look something like this:

If your totals don’t balance, then you need to double-check your figures and ensure you have calculated each item correctly.

If you are well versed in Excel, then you can create formulas to calculate the totals for you, so that when you edit the numbers it updates automatically. If not, it’s worth finding out and is relatively easy to do.

The totals should balance, but by monitoring your owner’s equity you’ll notice that if it goes up, then you have fewer debts. On the other hand, if the total goes down then you are owing more money than you own. This snapshot of the financial status of your business can be a useful tool for managing your finances.

Make balance sheets simple with Countingup

By setting up a Countingup business current account, you can manage all your financial data in one place. The app comes with free built-in accounting software that automates the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business’ finances, profit and loss statements, and tax estimates, and you’ll be able to create and send invoices in seconds.

Find out more here.