Do I need an accountant for my limited company?

Table of Contents

If you are a director of a limited company you are not legally required to appoint an accountant. However, there are many benefits to doing so. In this article, you will learn how an accountant can help improve your business, what accountants don’t do, costs, and how to choose the right one.

Let’s start with six key ways in which an accountant can help you run your business.

1. Preparing and submitting annual accounts

Limited Companies must complete an Annual Return and most directors will need to complete Self-Assessment Tax Returns. An accountant will ensure your submissions are accurate and correct.

Please note that directors do not have to file tax returns if all their income is paid and taxed through PAYE and there is no requirement for directors to register for Self Assessment if they do not receive taxable income.

2. Preparing and submitting VAT returns

Limited companies with a turnover exceeding £85,000 per annum must submit a VAT Return to HMRC up to four times a year. This is a record of the previous three months of:

- Sales and purchases

- VAT owed

- VAT you can reclaim

Even if you have no VAT to pay or reclaim, you must still submit a VAT Return. Appointing an accountant will save you time on the admin associated with VAT returns so that you can focus on growing your business.

3. Advising on tax issues

Have you been keeping up-to-date with tax law? Don’t fret – most of us haven’t, and with an accountant you won’t need to.

“An accountant is your personal guide through the maze of taxation and statutory requirements allowing you to concentrate on your core business” explains George Kendall, Accountant and Tax Advisor.

With their in-depth understanding of tax laws and how to apply them, accountants can help you minimise the tax your business pays.

“You’ll receive complete peace of mind from knowing that an expert is looking after your company’s administrative requirements and working hard to legally minimise your tax liabilities” says David Walton, Founder of Walton Accountancy.

4. Helping you meet HMRC deadlines

Did you know that you need to file your first year accounts with Companies House within 21 months of your company’s incorporation date? Or that you must pay Corporation Tax (or tell HMRC that you don’t owe any) within nine months of your accounting period for Corporation Tax ending?

An accountant will help you keep compliant and avoid any penalties for missing HMRC deadlines.

5. Filing payroll runs

When you have staff on payroll, there are several tasks you must complete each tax month. Tax months run from the sixth day of one month to the fifth of the next.

“You did not get into business to spend time on HMRC forms, payroll and tax. That is where accountants come in” says Velichka Filipova, Managing Director of VNF Accounting.

6. Helping you make smarter business decisions

A review of your business finances by your accountant can help you spot problems and opportunities, and provide guidance towards any course corrections needed over the next financial year.

“We give valuable insights to our clients which allows them to make better decisions, covering things that aren’t always obvious” says Naveed Mughal, Purlieus Consulting.

What accountants don’t do

Accountants don’t usually perform bookkeeping tasks unless you’re paying an extra fee. You can make significant savings here by incorporating some simple bookkeeping habits into your everyday. Find out more below!

What is bookkeeping and can I do it myself?

Bookkeeping includes recording your business expenses, raising invoices and chasing payments. It also involves reconciling accounts, which means matching each transaction you’ve made with a corresponding entry in your accounting software. Many accountants offer software to help you with these tasks.

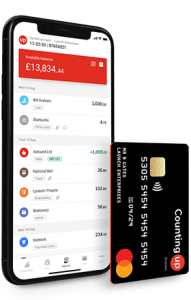

To automate both bookkeeping and reconciliation, more and more accountants are recommending Countingup to their clients. It’s the business account that automates bookkeeping. The app is a two-in-one business account and accounting software, helping over 30,000 business owners save time and money.

“Countingup is an accounting software package that is ideal for small businesses and sole traders. Our clients are saving time and money with Countingup” said Chris Wade, Founder of Lealindis Accountants.

As all your business data is in one place, with Countingup you won’t need to spend time reconciling transactions. You’ll also be avoiding the continuous lags and errors associated with connecting an existing current account to accounting software.

The app will send you notifications to snap receipts when you spend money on business expenses – helping you keep organised and removing the time and hassle from bookkeeping admin.

Do I need an accountant or can I just use software?

Many small businesses start out with limited cash flow and don’t appoint an accountant in effort to keep costs down. Although it is vital to keep on top of your cashflow, we recommend that you consider the benefits an accountant could bring to your business.

Using the right tools and appointing an expert with relevant knowledge and experience means you can rest easier and have more time to spend growing your business.

“Traditionally, accountants and accountancy software comment on what happened in the past. By using the latest tools and apps, like CountingUp, your accountant can help you plan your future business success” says Tax Expert, Iain Rankin.

How much does an accountant cost?

Accountants charge for their experience and knowledge that can help improve your business in the long run.

“We enable our clients to make better business decisions and get a better understanding of their company to increase profit and make their businesses more valuable” says David Poole at WL accountants.

As with many services, there are different pricing levels to choose from.

Some accountants will charge a one-off fee to prepare and submit your annual accounts, while others provide a range of services for a fixed monthly fee.

Depending on the type of practice you go with, price is usually based on:

- The complexity of your business

- The services provided

- The practice location

Unless you are enthusiastic to meet with your accountant in person, location is something you can use to your advantage and make savings on. For example, a practice based in central London will charge a lot more than one based in Hull.

A few more tips:

- Make sure to check whether a practice offers the services your business needs.

- Keep an eye out for hidden extras. Some cost breakdowns include accounting software, while others add it on afterwards.

- Remember to check if your quote includes VAT.

Finding the right accountant

“A good accountant is approachable, contactable and saves you time and money” – Jason Cannon at Figures UK Accountancy

There are many types of accountants, each specialising in various forms of accounting and different industries. Depending on your business, you may benefit from the tax or advisory services of a firm with expertise in startups, property or international e-commerce.

Questions to ask an accountant

Many practices offer a free consultation. Here are some useful questions to prepare yourself with:

- What are the costs (including any set-up fees) and which services are included?

- Which software do you recommend I use? Will this be included in your overall cost?

- Who will be my main point of contact?

- Is there a limit on customer support?

- Will you send reminders ahead of payments and other important deadlines?

- Will I be Making Tax Digital (MTD) compliant by working with you?

What is MTD and why do I need to be compliant?

One of the most important features to look for in an accountant is compliance with Making Tax Digital (MTD). It is the tax legislation coming into play in April 2022 for all VAT-registered businesses and involves:

- Switching from annual to quarterly tax filing

- Keeping digital records instead of paper and spreadsheets

Using accounting software built to handle the added responsibilities of MTD will be key to saving your business on admin time and accountant costs.

Plan your future success

To build a sustainable business, it’s important to invest in the right support. Ultimately, by choosing a combination of the right software and a good accountant, you will be setting yourself up for success with more time and insight to effectively grow your business.