Managing your accounts as a private landlord

Table of Contents

If you are a landlord trying to maintain reliable financial records, then this guide will break down how you can improve your bookkeeping skills. Let’s look at the following areas on how to manage your accounts as a private landlord:

- Keeping effective records

- Tracking rental income

- Understanding expenses

- Creating a profit and loss statement

- Tax for landlords

- The best accounting software for landlords

Keeping effective records

As a landlord, you must keep your financial records for five years minimum after the tax return deadline each tax year. So, keeping organised and easy-to-reference records is very important for your business and personal tax. If you are challenged by HMRC and cannot provide the right information, you could be fined.

It is best practice, and a good business habit, to keep separate records for each property you manage. This will allow you to calculate taxes and profits much more easily by keeping a clear record of income, overheads and expenses for your property or properties. You must separate records for properties that are fully furnished, part furnished and unfurnished because the expenses on these will be different. If you do not separate these out, it will be much more difficult when it comes to self-assessment season to lay out what you want to claim back.

If you have a limited company set up to manage your lettings, then keeping effective records for each property is important and Companies House has a lot of information to support landlords in this position.

As a starting point, you should be keeping records of the following things:

- Rent payments, or accounts if you use them

- Receipts (for any purchases for a property)

- Invoices (for any work carried out at a property)

- Bank statements (to back up all income and outgoings)

Tracking rental income

When you are letting out a property, you are technically ‘in business’, and there are certain tax obligations that come with that. This is why you must keep track of your rental income. This is the total amount coming in from your tenant or tenants.

Understanding exactly what is coming in will help you in determining how successful your property investment is, and make it easier to calculate profit from the venture. We will also look at the flip side of your rental income, which is your outgoings and expenses. It’s important to track both, and we’ll get into that later.

All landlords must declare all of their rental income to HMRC when it comes to submitting a Self Assessment tax return. Otherwise you risk being chased for the tax bill you owe as well as penalty charges for not disclosing the income. And if you’re wondering how HMRC will find out about potentially undisclosed rental income, they use a variety of methods including third-party whistleblowers and contacting letting agents. They may also check the Electoral Roll and Land Registry to identify where you live and what properties you own.

If you are concerned that your bookkeeping to date has been below par and you’ve not paid the correct tax (if any at all), you can use the HMRC Let Property Campaign to declare income from rental properties, without facing the penalties. If you have to use this service, it’s a good opportunity to reassess how you keep your records and what software you could use to simplify this.

Your accounts for a rental property should include the following items and proof (receipts or invoices) for each:

- The rent income (monthly and yearly totals, based on the agreed rent amount).

- Any regular costs (usually referred to as overheads). These can be flat or variable rates, such as ground rent, insurance, utility bills.

- Totals spent on maintenance or repairs for a property.

- The interest on your mortgage or loans for the property.

- Professional or legal fees.

- Costs of any regulatory inspections, such as the Gas Safety or electricity checks.

You will also need to keep records of any allowable expenses or capital expenses, which we will move onto next.

Understanding expenses

As well as tracking their rental income, a landlord will also need to monitor any expenses they incur for the property, in order to claim them back on their tax return. This means you won’t pay tax on these costs, and they could be rental, business or capital expenses.

Rental expenses

These are necessary costs that you have to pay whilst managing the rented property, such as:

- Letting agent fees, if you use an agency to oversee the property.

- Your landlord insurance.

- The cost of any bookkeeping software you use.

- Bills such as council tax, electricity, gas and water.

- The cost of any services that you have included in a rental agreement, such as a regular cleaner or gardener.

There are also government guidelines for allowable rental expenses. These are not your regular payments, like the ones listed above. These are expenses you’ve had to pay when running the rental that you are entitled to deduct from your tax bill, such as:

- Replacing domestic appliances or items (but it must be on a like-for-like basis, not an improvement)

- Unexpected maintenance or repair costs

- Insurance or accounting fees

As a rule of thumb, the guidelines state that if a cost is an “expense incurred wholly and exclusively for the property business, you can deduct that”. Ultimately, this means that any costs you pay purely for the running of the rental can be claimed against your tax bill.

The rules do change, however: for example, landlords used to be able to claim a 10% ‘wear and tear‘ allowance every year, but this has been replaced by the domestic items relief. So always check what is currently acceptable on the gov.uk site.

Business expenses

Along with rental costs, a landlord can claim tax back for the costs of running their business. This could be anything from travel expenses, advertising for the property, or the bill for a work phone. You can read more about acceptable expenses in our article here.

The same rule as above applies to business expenses, in that if the cost is incurred exclusively for running the business or as a result of renting the property, then it will be tax-deductible.

The exception to this rule is the legal fees that you incur before beginning the business. If you rack up solicitor, surveyor or estate agent fees in the process of buying a property to rent out, these will not be tax-deductible. This is because they are seen as capital costs and are part of making your business operational.

Capital expenditures

This type of expense is not allowable when it comes to your tax return, so it’s important to understand what they are before getting a shock when it comes to your tax bill. Capital expenses are costs that will be used in the business long term, such as:

- Building or adding something to the property that was not there before, such as an extension or a new security system.

- Improvements or upgrades to the existing building, such as a higher specification kitchen.

- Purchasing furnishings or appliances for the property that are upgrades, such as more expensive couches or a better dishwasher.

You cannot claim these back on your tax application, but keep records of any capital expenses because you could use them as part of your Capital Gains Tax if you choose to sell the property further down the line.

Similarly to the legal fees in business expenses, the costs of work before you start renting the property will also not be allowable tax expenses. This is because your investment in improving the state of the building for rent will be for the long term operation of the business.

Good accounting software will allow landlords to list expenses and calculate a rough expense total when it comes to doing their self-assessment. It’s important to keep records, in an app or elsewhere, to make it easier for you, or your accountant, to spot any unclaimed expenses when submitting your tax return and accompanying proof.

Creating a profit and loss statement

The goal for any landlord is to make a profit on renting out their property. To understand if you are, you will need to learn how to write a profit and loss statement.

A profit and loss statement combines your profit and expenses to show how much you’re making or losing. This is important for your accounting as it will show your results as well as give you a guideline amount that you will have to pay tax on.

This statement will also highlight any areas you need to change if you aren’t making enough profit, such as reducing the cost of repairs, or showing that you need to up the rent amount.

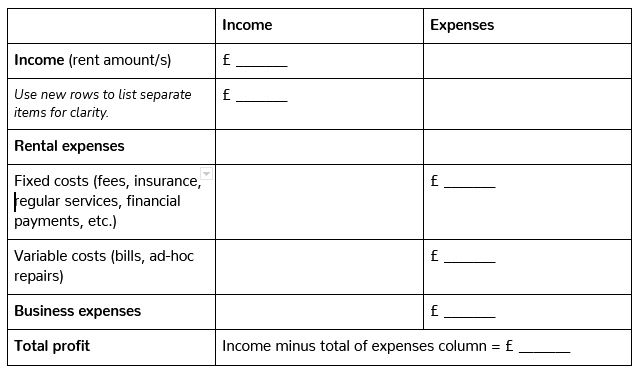

Below is an example of how this would look.

Tax for landlords

Accounting software can make tax payments easier, especially once you’ve figured out your profit. To calculate what you will pay tax on, follow these steps as detailed in the template above:

- Add together all rental income (even if you have more than one property)

- Add together all your allowable expenses (as mentioned, capital expenses are not tax-deductible)

- Then take away the expenses from the income

You must then declare your profits on a Self Assessment tax return. The deadline each year is usually the end of October for paper forms, or January 31st for online applications. The amount of tax you’ll pay will be determined by the total income you are receiving from your self-employment income, as well as any other income you may have, such as other employment, business ventures, or pension payments you receive.

Even if you are not due to pay any tax, because your rental income for that year is under the taxable amount, you should still submit the tax return to prove the income. If you haven’t done this when you think you should have, then look into the Let Property Campaign as mentioned above.

The best accounting software for landlords

Renting a property can be a way to make a bit of extra income, or if you have a portfolio of properties, you’ll be looking more closely at your business’ bottom line. Either way, any landlord needs a system that can organise the payments in and out that come with renting a property.

Bookkeeping software will hold all the relevant information you need to collect when it comes to paying your tax. At the touch of a button, you can identify payments that can be expensed or take a picture of a receipt that you will later need to claim back with.

An accountant will be able to keep you on the right track when it comes to regulations or rules on particular expenses, and often you can share your accounting app information with them directly. This will save any back and forward with paper records and provide added security for banking information.

Choosing software that is simple for you to upkeep and understand will be beneficial to you, your accountant and ultimately to HMRC when it really matters.

Countingup makes it easier to be a landlord

It’s simple to keep on top of your accounts as a self-employed landlord with Countingup, the business current account with built-in accounting software.

Countingup is saving thousands of people across the UK hours of accounting admin, by automating invoicing, expense categorisation, providing running tax estimates and more.

The two in one app encourages good record keeping and stores all your financial data in one place, making things faster and simpler when it comes to tax season, because your accounts will be organised and accurate for you, or your accountant, to manage easily. Find out more here.