How to create a profit and loss statement for self-employed hairdressers

Table of Contents

The profit and loss statement is an important document in running any business to have a good understanding of how much you’re making, where you can save on expenses, and where to improve the business. This article will look at how to create a profit and loss statement for a self-employed hairdresser by discussing the following areas:

- What is a profit and loss statement for?

- The income/revenue section

- The expenses statement

- How to calculate the profit/loss

What is a profit and loss statement for?

A profit and loss statement (often also called an income statement) is a financial report that shows all your ingoings and outgoings (money that enters and leaves your business). This statement will show you what your net income (often called the bottom line) is and if you have made or lost money over a period of time.

Profit and loss statements can also reveal a lot about how your business is run and how it can be improved. There are many reasons why you need good financial reports, such as:

- Tax purposes. It’s mandatory to have financial records when filling in a Self Assessment tax return. It’s crucial to get a profit and loss statement correct, as you are taxed on your net income. Your expenses will also be subtracted from your tax bill, so it’s an important document for both your own records and for HMRC when it comes to Self Assessment time.

- Proving the financial state of your business. If you ever need funding, you will have to provide detailed profit and loss records to banks for a loan application – or potential investors – to evidence the money you are making or losing.

- To improve your business. Understanding your incomings and outgoing will help you make more informed decisions about growth and improving everyday operations. Perhaps the small costs are adding up when you look at the profit and loss statement, and this will help you make smarter business spending choices.

To create a profit and loss statement, you can use an Excel or Google spreadsheet. To automatically generate profit and loss reports, Countingup, the business current account and accounting app will save you plenty of time on manual data entry. Next, we’ll look at the sections of the statement.

The income/revenue section

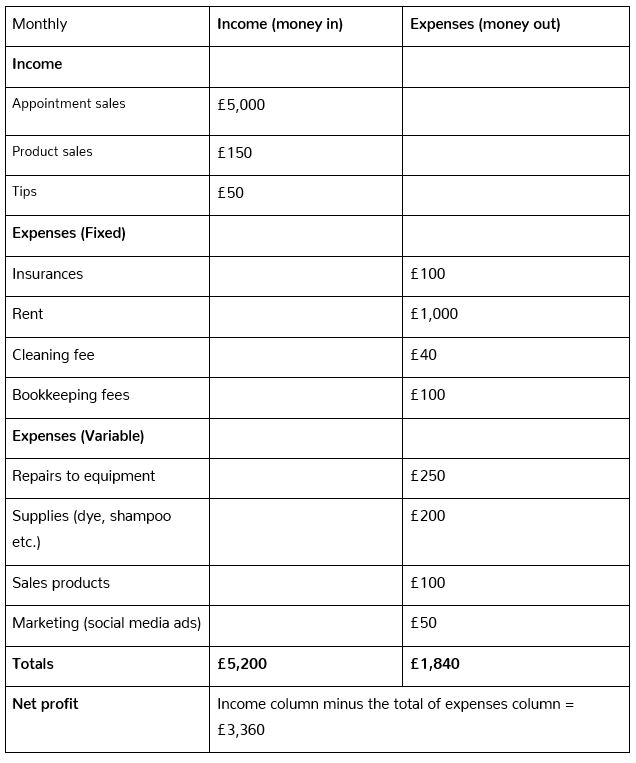

Your statement should have three columns: the description on the left, the income in the middle, and the expenses on the right. You can see a simple table further down in this article which is an easy framework to follow.

Now, decide what time period you are measuring. It might be most useful to make a monthly profit and loss statement so that you can monitor your spending and supply cost regularly.

Next, list any sources of income for your salon in the left column, using a new row for each source to avoid confusion. Give each source of money its value in the ‘income’ column.

For a hairdresser, this will include every customer sale you’ve done over the month, or week, or year, whichever period you are measuring. This may also include any tips you’ve received, sales of hair products or accessories that you have made, or if you have your own salon, you might also rent out chairs to other hairdressers. Any source of income must be listed in this column.

The expenses statement

Now move onto the expenses side of the table. List any areas that you have to spend money on and assign a value to each. This could include:

- The rent/mortgage payment on the salon

- Insurances you pay for the business

- The cost of your supply of products

- Purchasing products that you sell on

- Facilities (cost of water, heating or electricity bills)

- Cleaning or maintenance costs

- Marketing (you might pay for social media advertising, business cards, leaflets etc.)

You can separate the expense column into fixed costs and variable costs. Fixed costs are expenses that remain the same every month, like your insurance and rent payments. Variable costs change from month to month, such as the cost of your supplies based on customer demand.

You will also likely incur business expenses which will also be subtracted from your total income, as you won’t be taxed on costs that are related to running your business. Then the total expenses will be subtracted from your total income to give your net profit.

How to create the profit and loss statement

Using a simple table, spreadsheet, or app that does the calculations for you, you should end up with a version of the table below.

So in this example, the hairdresser’s bottom line is £3,360 for the month. If the expenses figure had been higher than the income, resulting in a negative final balance, that would mean the business is currently not profitable for that month.

You might even want to break down the sales section into more detailed figures to have more clarity on the breakdown of your sales total. For example, you might separate the ‘haircut’ figures from the ‘hair dye’ appointments so that you can understand which service brings in more money and what that does to your supplies’ cost that month.

A good profit and loss statement should help you highlight ways to improve your business operation and show you how much you are making or losing.

Save time on accounting admin with Countingup

If you’re self-employed, you’ll know how much time financial tasks take out of your busy day. Why not make some of those tasks simpler?

With the Countingup business current account and accounting app, you can view live profit and loss insights, record your expenses digitally on the go, and have them automatically categorised too. It means that you can spend less time focusing on time-consuming financial admin and, instead, focus on what you do best.

Find out more here and sign up free today.