How to calculate net profit margin

Table of Contents

Calculating net profit margin is straightforward, but learning how to use it well can take time. Your business’ net profit margin is perhaps the most important figure in all of the business world, so understanding it is key. From new sole traders to shareholders of major international companies, everyone’s focus is on what net profit margin a business makes.

In this guide, we’ll walk through everything you need to know about net profit margin, including:

- How net profit margin is calculated

- What it’s used for

- How to improve your net profit margin

- How Countingup can help you manage your business finances better

How net profit margin is calculated

Net profit margin is the net profit your business makes expressed as a percentage.

To calculate it, you’ll first have to calculate your net profit for a given period of time (usually a week or month). Combine all of your expenses during this time (cost of goods, other expenses, taxes, and debt) and subtract this figure from the total income you made during this point also:

Net profit = total income – total expenses

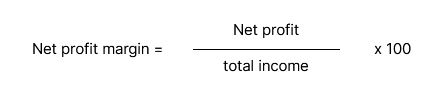

Next, take your net profit and divide it again by your total income, then multiply by 100.

Net profit and net profit margin figures can be negative, meaning your expenses are larger than your income. This is common for businesses as they get started and can last until their second year. We’ll discuss what you can do to fix this in the sections below.

What are net profit margins used for?

Net profit margins are useful when comparing profits from different periods (for example, month to month). Using the percentage figure is easier than comparing actual monetary values as it gives context to how much money you turned over (in the form of your revenue) and how much you lost to expenses (the remaining value to make 100%).

Net profit margins are also a more useful figure when scaling up your business and comparing investment and expenses across time. Using your net profit margins, you can plan specific expenses and compare more recent investment strategies to old ones. Similar to before, this allows you to use your total revenue and net profit margins as common reference points for each month when deciding new growth strategies.

Net profit margins are still useful even if they’re negative or in single digits as they show if you’re losing money and by how much. You can grow your net profit margin to reduce your losses by gaining higher sales figures or cutting expenses.

Finally, net profit margins offer critical information to investors and lenders as they are a gauge to understand how well you’ll be able to finance loans or return investment. Therefore, understanding the mechanics of your net profit margins and how it impacts your business more widely is an essential piece of information for new business owners to have.

How can I maximise my net profit margin?

Increasing your net profits margin can be simple but any route you take has consequences. Your net profit margin can be increased using one of two methods: increasing revenue (charging higher prices, selling more units, etc.) or decreasing expenses (finding cheaper suppliers, switching raw materials, investing in more efficient machinery, etc.).

Because no two businesses are the same, you’ll know which type of increases to revenue or decreases to expenses are more viable. As you choose, we’ve included some key factors consider:

- Invest as much as you can earlier on for long-term gains. When setting up, the main goal for many new businesses is to have sustainable profits. However, your business may be in a better position long term if you choose to invest more early on. Unfortunately, this may mean forgoing salary support during this time. Choosing between investment or savings periods will be an ongoing factor in your business venture. However, this question is most important while you’re first trying to establish yourself.

- Choose successful investments. When choosing to take new marketing directions or adding new products, consider the level of necessity, risk and reward in each step you take. Although it’s difficult to tell the rewarding options from the damaging ones, understanding these investment outcomes is critical to growing your net profit margins. No one can tell the future, and you will make mistakes, but you can get better so learn as much as you can from your risks.

- Decrease expenses as much as possible. Regularly checking your accounts can be a useful way to decrease your expenses. Particularly, focus on identifying costs that can be reduced easily (such as switching suppliers or sourcing deals for new business customers), rather than needlessly minimising more necessary ones.

- Take a long-term view of your investment strategies. Some business models are only successful and profitable on a certain scale, therefore minimising costs might not be an effective or relevant strategy. If your business is in this situation, consider transitioning to longer-term strategies of investment rather than short term ones to increase your net profit margins. This can include acquiring debt or investment to fund more efficient machinery or expensive advertising.

How Countingup can help you maximise your net profit

If you’re looking to use your net profit margin like a pro, you’ll need Countingup.

With Countingup, managing your business is easy. With your business current account and accounting software in one app, we’ve automated the time-consuming aspects of your financial admin.

With all your important figures ready at a glance, you can quickly and easily understand how changes to your net profit margins affect your trading. With the time you save, you can focus on doing what you love and do best.

Cut out the stress of bookkeeping with automatic invoicing and helpful receipt capture tools. Find out more here and sign up for free today.