What is a balance sheet?

Table of Contents

As a small business owner, it’s important to know which financial reports you will need to use most often and how to pull them together quickly and effectively. This article will look at what a balance sheet is and what it means for your business, by looking at the following areas:

- What is a balance sheet?

- What does a balance sheet need to include?

- How to pull together the balance sheet (with example)

What is a balance sheet?

A common report for small businesses that checks their financial health is a balance sheet. The sheet will show the business’ net worth as well as showing how well a company will be able to pay its financial obligations and operating costs.

Simply put, the balance sheet is a two-sided chart. On one side of the chart, it will show the value of what you owe, and on the other side, what you own.

As the name of the balance sheet suggests, the total of each side should come to the same amount to show if your business is financially stable or not.

Later, we’ll look at a couple of examples of how a balance sheet should look and it’s very simple to put together. First, let’s go through what figures need to be included.

What does a balance sheet need to include?

Below are the three items that you’ll need to understand to fill in the balance sheet properly.

Assets

First, you need to total up the value of all the assets your business holds. Assets are items or resources that have financial value. This can include both physical items, such as machinery or vehicles, and sometimes intangible items, such as copyrights or branding.

Assets are often separated into two groups, based on how quickly that asset can be turned into cash. Let’s look at what is counted as current and fixed assets.

Current assets can be quickly converted into money. These are things that are fairly simple to sell and value, such as:

- Stock and inventory

- Cash in the bank

- Money owed to you (through unpaid invoices)

- Customer deposits

- Office furniture, equipment or supplies

- Phones or laptops

- Even relatively trivial items like a fancy coffee machine or pool table

Fixed assets are valuable items that would be a more long-term sale and hence it would take longer to get the cash in your pocket, such as:

- Property or buildings

- Machinery

- Specialised equipment for your business operations

- Investments such as stocks or bonds that may take a while to cash out

- Vehicles

Start preparing your balance sheet by listing any current assets you own in a spreadsheet with their value in the next column. Then, underneath, list your fixed assets and their values. Having each item separate will help you gain a better understanding of what is the most valuable to your business. You’ll then add up the total value of all assets.

Liabilities

The next step is to list your business’ liabilities. These are the funds that you owe to other people, banks or businesses and can cover a variety of debts, such as:

- A business loan (the total, not the monthly payment amount)

- A mortgage or rent payment on a property

- Supplier contracts you owe

- Your accounts payable total

- Other financial obligations, such as paying wages or freelancers for support

- Taxes due to be paid to HMRC

List these in the same way you did with your assets, on a spreadsheet with their values in a separate column.

Think of your assets like money going into your pocket and liabilities as the items that take it out of your hands. This might help you when listing items and making sure you don’t forget anything.

Owner’s equity

The last total you’ll need to work out is your owner’s equity in the business, but what is owner’s equity? This is how much of the assets you own as the owner of the business. If you are a sole trader or the only owner of the company, with no shareholders, then this will be a simple calculation.

Basically, your owner’s equity shows how much you would be left with if all assets were sold and all debts were paid. You can work it out with a simple subtraction sum, with the following formula:

Assets total – Liabilities total = Owner’s equity

How to pull together the balance sheet

Now you’ve totalled up all the relevant figures, how does this look in a balance sheet?

To pull together the balance sheet, you’d add your assets on one side of a table and your liabilities and equity on the other. As the name suggests, the totals should balance and fit this formula:

Assets total = Liabilities total + Owner’s equity

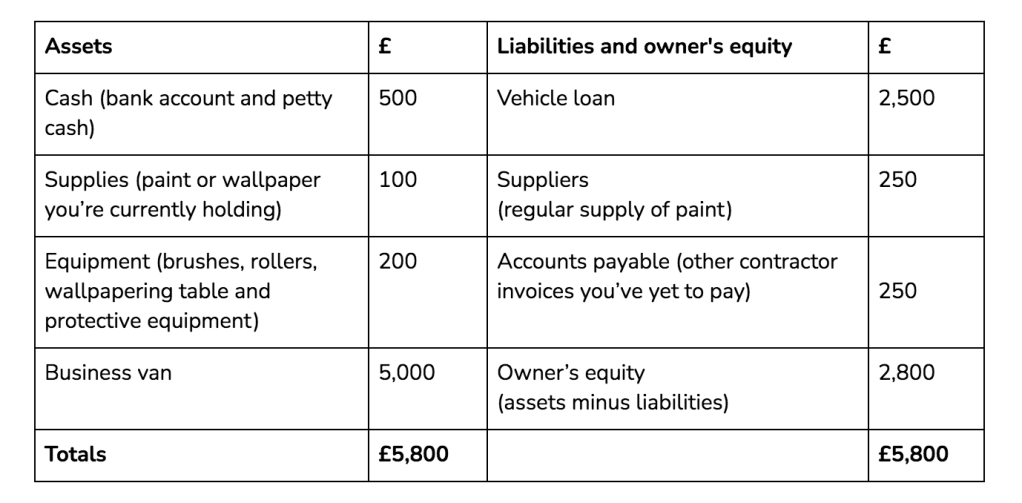

Using a self-employed painter and decorator as an example, the balance sheet could look something like this:

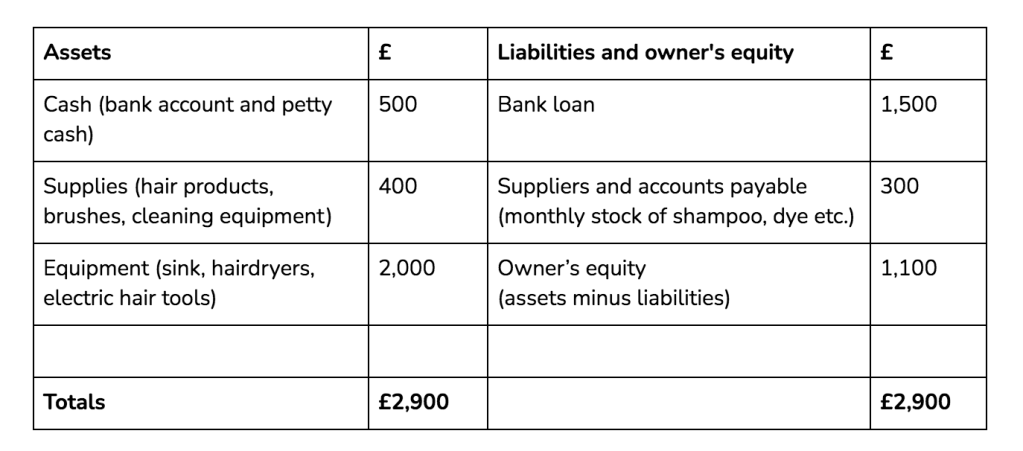

As another example, the balance sheet could look very similar if you were running your own hairdressing business, either from rented premises or travelling to customer homes.

If your totals don’t balance, then you need to double-check your figures and ensure you have calculated each item correctly.

The totals should balance but by monitoring your owner’s equity you’ll notice that if it goes up, then you have fewer debts. On the other hand, if the total goes down then you are owing more money than you own. This snapshot of the financial status of your business can be a useful tool for managing your finances.

Save time on financial admin with Countingup

By setting up a Countingup business current account, it’s easier to keep organised when it comes to your business finances. The app comes with free built-in accounting software that automates the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business’ finances, profit and loss statements, tax estimates, and you’ll be able to create and send invoices in seconds.

You can also share your bookkeeping with your accountant instantly, without worrying about duplication errors, data lags or inaccuracies. Seamless, simple and straightforward!

Find out more here.