Invoice template for sole traders

Table of Contents

When you become self-employed, one of the first things you’ll have to learn is how to create invoices properly so that you can be paid for your work quickly. This article will cover the areas you need to be aware of when creating an invoice as a sole trader:

- What invoices are

- How invoices work

- How to write an invoice as a sole trader

- Common invoice mistakes

What invoices are

An invoice is a request for payment, given by a business to the customer. Invoices are often sent after the sale or services have been completed, and an invoice can be used for recurring work as well as one-off payments.

An invoice will include details on what the goods or services were and how much must be paid in return for the work. Businesses can still use physical paper invoices, but there are many accounting software options available to create your own invoices. A simple word document or PDF will also do the trick.

As a sole trader business, you should refer to your payment requests as invoices, but customers may use the word ‘bill’ to mean the same thing. However, bills and invoices can be different in a few ways.

A ‘bill’ might be used in an industry where they charge by the hour, such as an accountant or legal firm, which may deal in ‘billable hours’. The invoice will then break down the hourly charge and total hours being billed to the client. You might also use the word ‘bill’ in relation to several invoices that can be paid together, as a total bill.

How invoices work

Once a customer has agreed to pay for goods or services from your business, you should detail the agreement in a document to request the payment. It’s best to create the invoice beforehand so you have the details of what is agreed, but generally you wouldn’t send it to the customer until after the work is complete. Any extra products used, or unexpected extra hours, can be added to the original agreement, or detailed in another invoice.

After your customer has received the invoice, UK guidelines state that they have 30 days to pay you for your services. This 30-day window is the legal UK requirement unless you have specifically agreed to an alternative payment period in a contract.

How to write an invoice as a sole trader

You can create a simple one-page word document as an invoice. We will break this into three parts: the top, middle and bottom of the page.

Top of the invoice

Start in the top left corner, and put your logo in. Your invoices should be straightforward, detailed and professional-looking, so take this opportunity to feature your company logo.

Now, in the top right corner, address the invoice to your customer, as you would a letter. Include as many of the customer’s details as you have:

- Customer name

- Company name (if applicable)

- Billing address (rather than shipping or delivery)

- Phone/email

- Date the invoice was issued

Middle

Now onto the body of the invoice. Here you should start like a letter, but instead of ‘Dear Sir/Madam’, start with ‘For the attention of: _______’ and insert your customer’s name.

Now, underneath this line, write ‘Invoice Number: ________ ’ and create a unique reference.

You might want to number it, like 0001 to keep your invoicing simple and easy to reference. You might use an address instead if you are a tradesman, to identify where you were working. Or you might use initials and a date, to separate any invoices that were created on the same day, for example, LP010621, for a customer named Lewis Peters on 1st June 2021.

Underneath the reference, add ‘Payment due: _______’ and insert the date. As mentioned, UK law dictates 30 days, but if you have agreed sooner or later with the customer, add this in here.

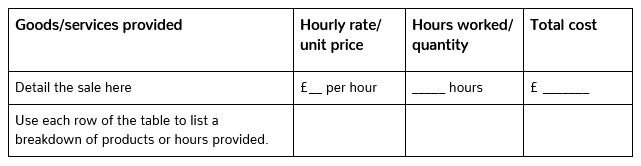

Now create a table in the centre of your invoice. This will include the goods or services you provided, how much they cost and the total payable to you. An example is shown below, but adapt the section titles to ones that apply to your business.

Bottom section

Underneath your table, write a sentence on the payment terms (ie. the standard 30 days, or the period you agreed to).

Afterwards, communicate your payment options. If you’re using digital invoices, include a link to where they can pay you. If using paper invoices, simply include the bank details (sort code and account number) and reference they should use when paying you via BACS or online banking. Mention if you take card payments, cash or cheques, too, in case the customer would prefer those methods.

To sign off, include a few words of thanks to the customer for their business.

As a footer, you should add your business name and registered address. This is standard for a professional-looking business letter.

The government has guidelines on what should be included in sole trader invoices, so always check that you have covered each item on their list.

Common invoice mistakes

Avoid the following errors in your invoices by double checking all your information:

- Wrong banking details

- Incorrect dates for payment

- Wrong customer details

- Missing the unique reference

- Miscalculated VAT total

- Asking for the wrong total to be paid

- Not including enough detail on the sale table

How Countingup can make invoicing simple

Avoid the pitfalls of paper invoicing and create digital invoices in seconds with the Countingup app. The business current account with built-in accounting software is saving UK sole traders hours of admin, by automating invoicing and notifying you when you’ve been paid.

You’ll gain live business insights from a running Profit and Loss report as well as automatic expense categorisation and tax estimates – saving you time and avoiding any surprises when it comes to Self Assessment season. Find out more here and try the Countingup app today.