Save hundreds of £££s

Most small businesses pay for a business bank account and accounting software or accountant to file their VAT. With Countingup, you can do it all in the app for one small fee.

Whether you’ve just registered for VAT or you’re looking for a simpler way to file your VAT return online, Countingup makes it easy:

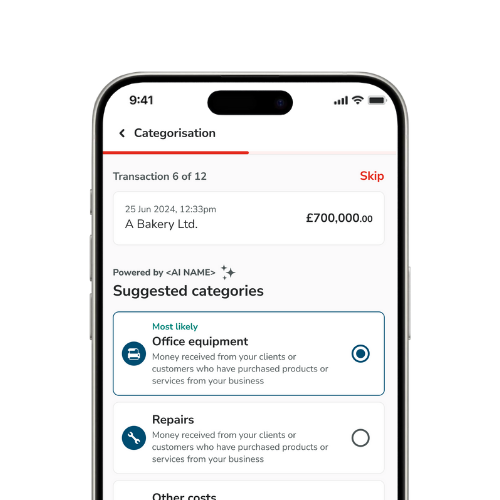

Countingup automatically assigns incoming and outgoing transactions to the correct tax category and adds the VAT to your return. One less thing to worry about if you’re new to VAT.

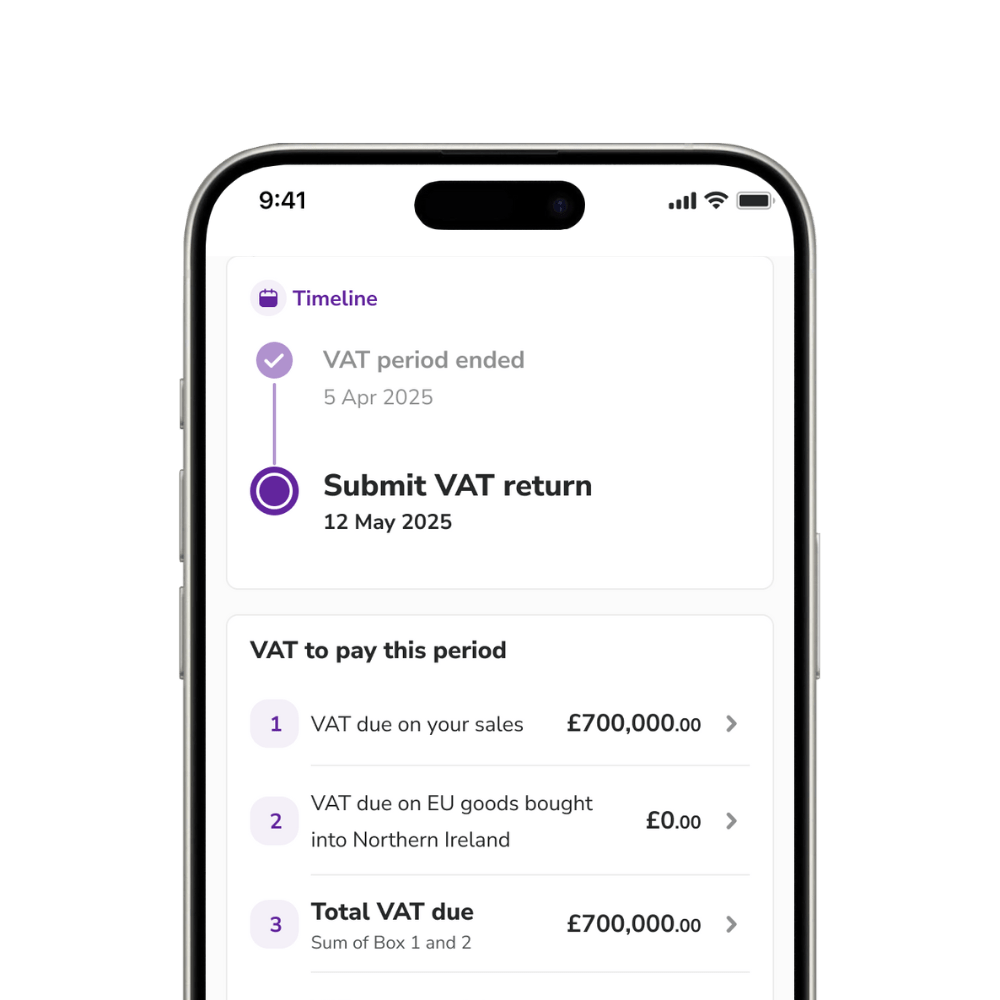

Connect directly to HMRC to track past and upcoming VAT submissions. Countingup even notifies you when a deadline is approaching so you know exactly what to file and when.

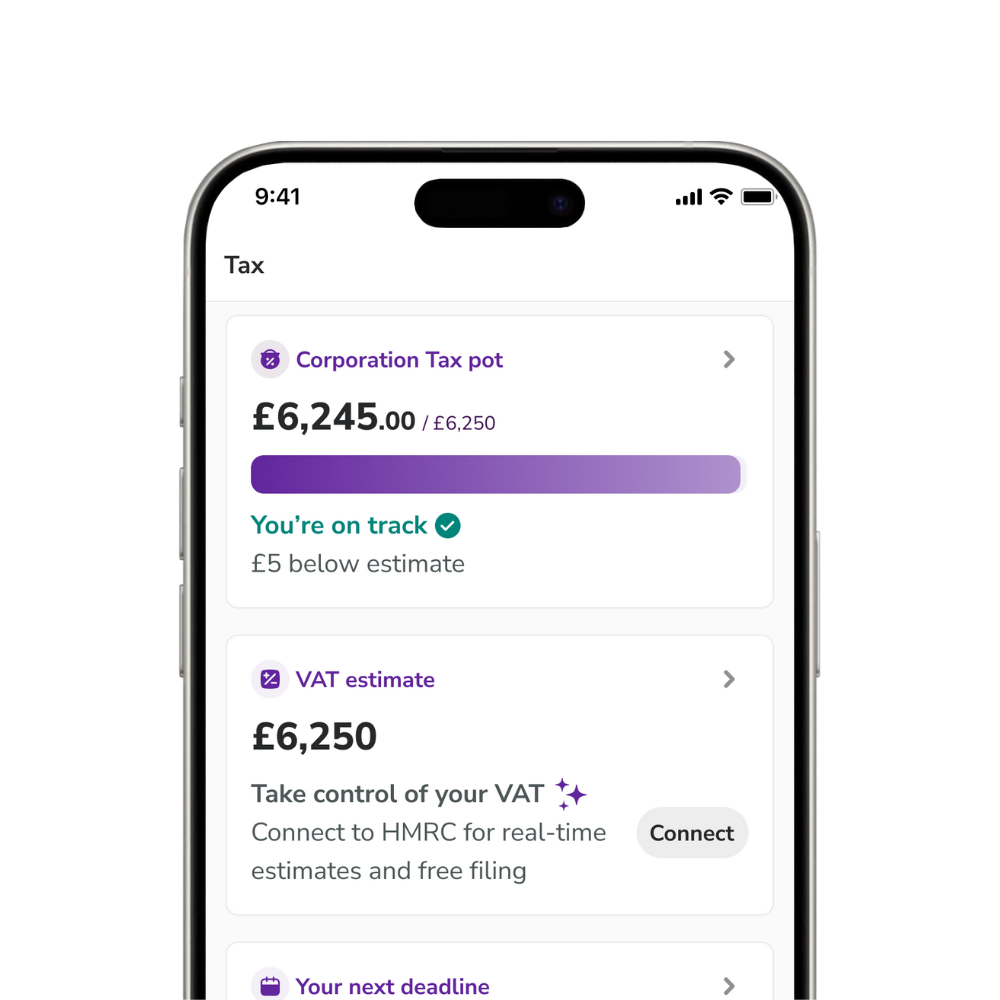

Every time you spend or receive income, your real-time VAT estimate automatically updates so you know exactly how much money to set aside for your return.

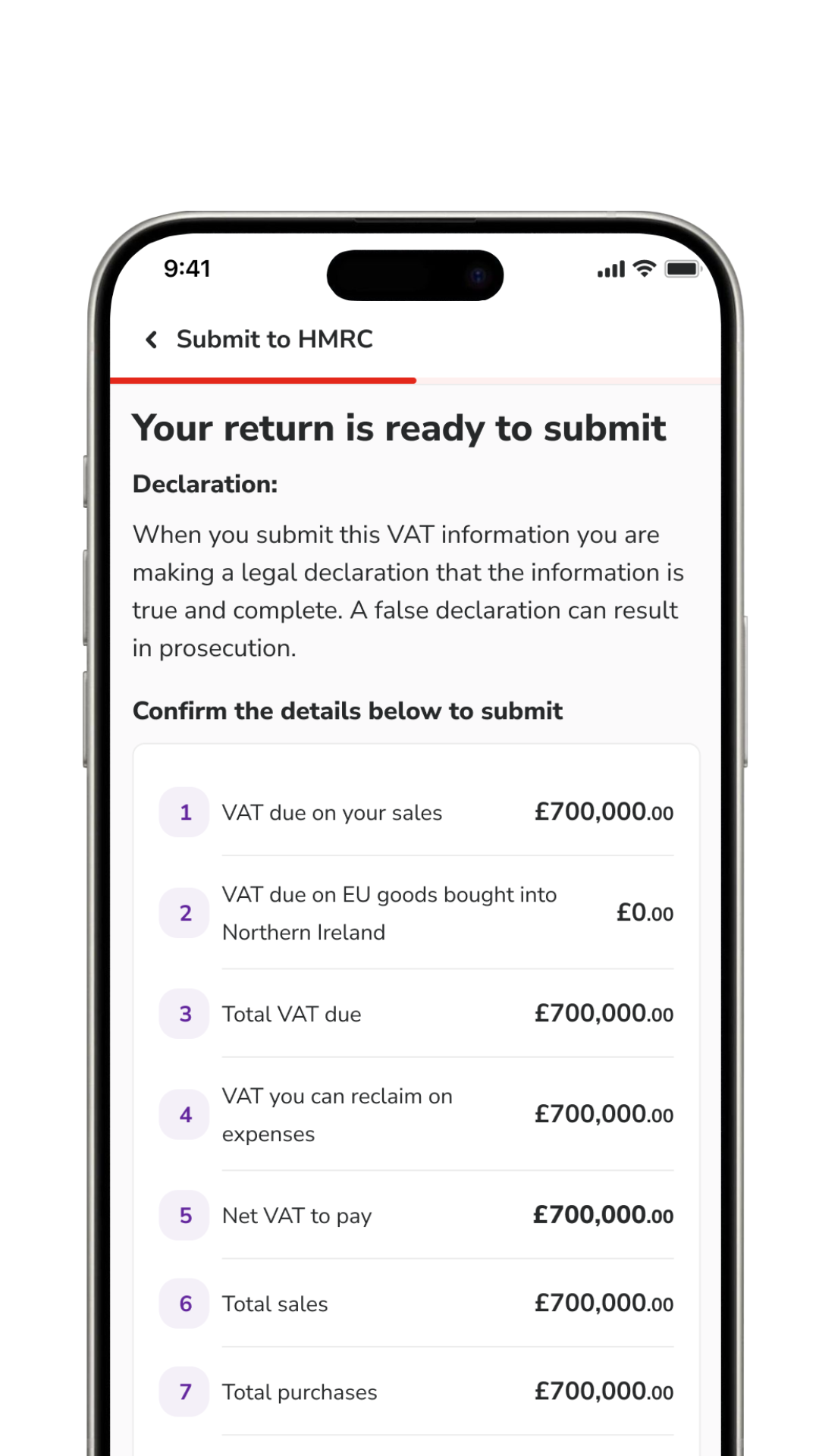

We know you’re busy. That’s why you can generate a return from your transaction data in one tap. Just review to make sure it’s accurate and submit in another tap.

Making Tax Digital (MTD) is a HMRC initiative designed to make it easier for businesses to manage their taxes digitally. If your business is VAT-registered, MTD means you must keep records digitally and submit VAT returns through compatible software, like Countingup.

With Countingup, MTD compliance is built in:

A VAT return is a report you submit to HMRC showing how much VAT your business has charged customers and paid on purchases.

Not if you use Countingup. Our app handles digital record keeping, VAT calculations and submissions, keeping you MTD-compliant. With Countingup, you can stay in control of your finances without paying for extra accounting software or an accountant.

Yes. Before you submit, you can tap on any transaction to check or edit details to make sure they’re accurate and ready for HMRC.

With Countingup, you get a real-time VAT estimate in the app which updates based on your income and expenses. You’ll always know how much VAT to set aside, so there aren’t any surprises when it’s time to file.

No problem. Countingup connects you directly to HMRC and your return is automatically generated from your transactions, making the process easy even if it’s your first time.