What are business rates?

Table of Contents

If your business uses a property, you’ll have to deal with business rates. At first glance, it might seem a little complicated. But don’t worry, in this article, we’ll take a closer look at business rates. More specifically:

- What are business rates?

- How are they calculated?

- How are they different in each area of the UK?

What are business rates?

Business rates are property taxes, paid on non-domestic properties like offices, shops, pubs, and warehouses. Basically, anything property that’s not somebody’s house.

Each building’s business rate is set annually, every April, but payments are made every month. They are used by local authorities to help fund local services.

How are business rates calculated?

Though it differs slightly in each region of the UK. The process for calculating involves a lot of the same steps.

Property valuation

Business rates depend on the value of the property in question. In England, Scotland, and Wales, this is called ‘rateable value’. In Northern Ireland, it’s called Net Annual Value (NAV). The value is determined by assessors based on the rental value of the property on the open market.

Multipliers

The next step requires different multipliers. It’s a small figure (usually around 50 pence), but will be slightly higher or lower, depending on the size of your business. Multiply this figure by your property value to get your basic business rate.

In Scotland, the multiplier is called ‘poundage’, but it means the same thing.

In Northern Ireland, the multiplier is found by adding the non-domestic regional rate and the non-domestic district rate. We’ll explain how this works down below.

Discounts

Finally, you can apply for discounts on your business rate. These are called ‘reliefs’. There are a lot of different reliefs available for each region of the UK, which we’ll look at next.

How do business rates differ in each area of the UK?

This is where things get a little complicated because business rates are calculated differently, depending on where you are in the UK.

England and Wales

First, you’ll need to know your property’s ‘rateable value’.

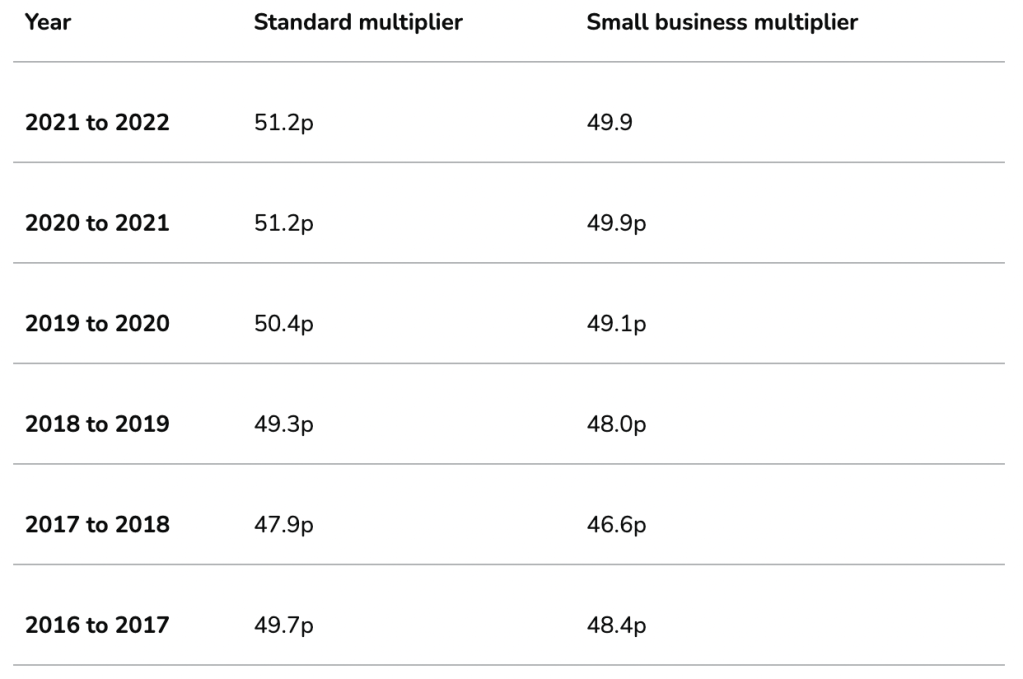

Rateable value is determined by estimates made by the Valuation Office Agency (VOA). You can find out your property’s rateable value on the HMRC website.Next, you multiply the rateable value by the right multiplier – check out the table below.

You should apply the standard multiplier if your property’s rateable value is £51,000, or more. If it’s less, you should use the small business multiplier.

For example, let’s say you own a hairdressing salon with a rateable value of £40,000, in 2021. As it’s less than £51,000, you’d apply the small business multiplier. We’d work it out like this:

Rateable value (£40,000) x Small business multiplier (49.9 pence) = £19,960

Finally, you can deduct any business rate reliefs you’re eligible for. Some common business rate reliefs include:

- small business rate relief

- rural rate relief

- charitable rate relief

- enterprise zone relief

- hardship relief

- retail discount

- local newspaper relief

- Exempted buildings and empty buildings relief

- Transitional relief

We won’t go into too much detail about how to qualify for these, but you can find out for yourself, here.

Altogether, it’ll look like this:

(Rateable value x multiplier) – relief discount = annual business rate

Scotland

Business rates in Scotland are calculated by a similar process.

First, you find your property’s rateable value. You can find that here, or have it valued by a Scottish assessor.

Next, you multiply the rateable value by ‘poundage’. Poundage is just usually a flat rate of 49 pence. However, properties with higher rateable value will be charged a little extra.

Intermediate property values (£51,000 – £95,000) will be multiplied by 50.3 pence.

Higher property values (£95,000 and above) will be multiplied by 51.6 pence.

Unlike England and Wales, property values are based on valuations made on 1 April 2015. The next valuation date will be 1 April 2022.

And finally, like before, you can get a discount by applying for reliefs. Some of the most common reliefs apply if your property:

- has a small rateable value (Small Business Bonus Scheme)

- is in a rural area

- is used for charity or religious purposes

- has been empty recently

There are a whole lot more than those mentioned above. But, you can see a full list of non-domestic rate reliefs here. When you know your rateable value, poundage, and reliefs, you just need to do some more maths.

(Rateable value x poundage) – relief discount = annual business rate

You can find an estimate of your annual business rates using the Scottish Government’s non–domestic rates calculator.

Northern Ireland

In Northern Ireland, business rates are calculated using three figures:

Net Annual Value (NAV)

The annual rental value of your property. The valuation is based on similar properties in the area, and they’re based on values assessed from 1 April 2018. You can look up your property’s NAV here.

Non-Domestic regional rate

A rate set annually by the Northern Ireland Executive. They apply to each district council area. You can find your non-Domestic regional rate here.

Non-Domestic district rate

A rate set by each district council in Northern Ireland. You can find your non-Domestic district rate here.

Once you have these 3 figures, it’s time for a little more maths.

Add your regional and district rates together. Then multiply that number by your NAV and you have your annual business rate. Like this:

NAV x (non-Domestic regional rate + non-domestic-district rate) = Business rates.

You can also use a rate calculator for this sum.

Save time on financial admin with a simple app

The Countingup business current account comes with a handy app that automates a lot of the tedious parts of financial bookkeeping.

It’ll keep track of all your income and expenses (like business rate payments!), in real time, so you’ve got an accurate picture of your business’ performance.

Find out how Countingup can save you hours of financial admin to help make your bookkeeping a whole lot easier here.